Budget Meetings: Also known as “yes let’s have a boring discussion about how we AREN’T going to be spending our hard earned money on FUN this month! Yay!”

Budget Meetings: Plan Your Financial Future Without Losing Your Mind

Chris and I have been having monthly budget meetings since we decided to get serious about paying off our debts. We set aside a nap-time hour on either Saturday or Sunday before the next month starts and, being that I am the queen of spreadsheets around here, I do all the prep and present the next month’s budget for discussion.

These meetings are SO important for the health of our finances because it keeps us on the same page constantly and he always knows exactly where we are financially during the month and what is happening with our money when we make our debt snowball payment.

Before we started Dave Ramsey, I would just check the bank account online every other day or so and write down all the new, random, unplanned (and unnecessary) charges, and then at the end of the month wonder where the heck all our money was.

Now that we are on this written budget, I hardly even have to check the bank account anymore and I know exactly where every dollar is, will be going, or has already been. I’ve written out a map for our money and it is no longer a lost little tyke in the woods, looking for a place to land. We’ve given it a GPS and a Corvette to get to the finish line as quickly as possible, and cleared all the traffic to avoid any delays.

Anyways, I happen to love all the organizing and planning and detailed work that comes with this. Chris, however, does not, and understandably would rather play Playstation for an hour than do math and I can’t really say I blame him. Not everyone is as nerdy as me! 😉 So to make it fun for him (and even more fun for me if that were even possible) here are a few things we do for budget meetings!

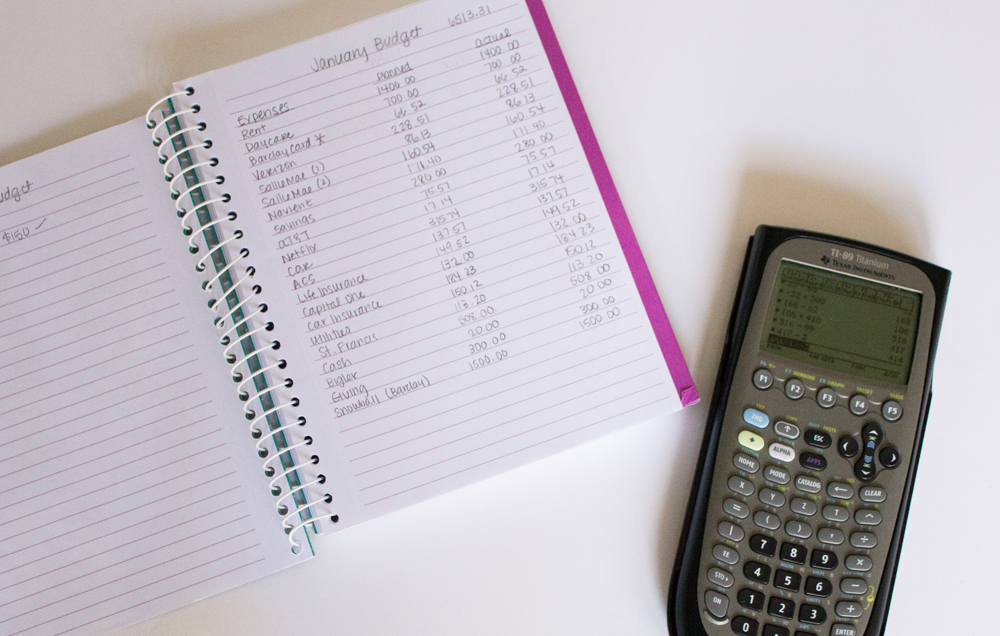

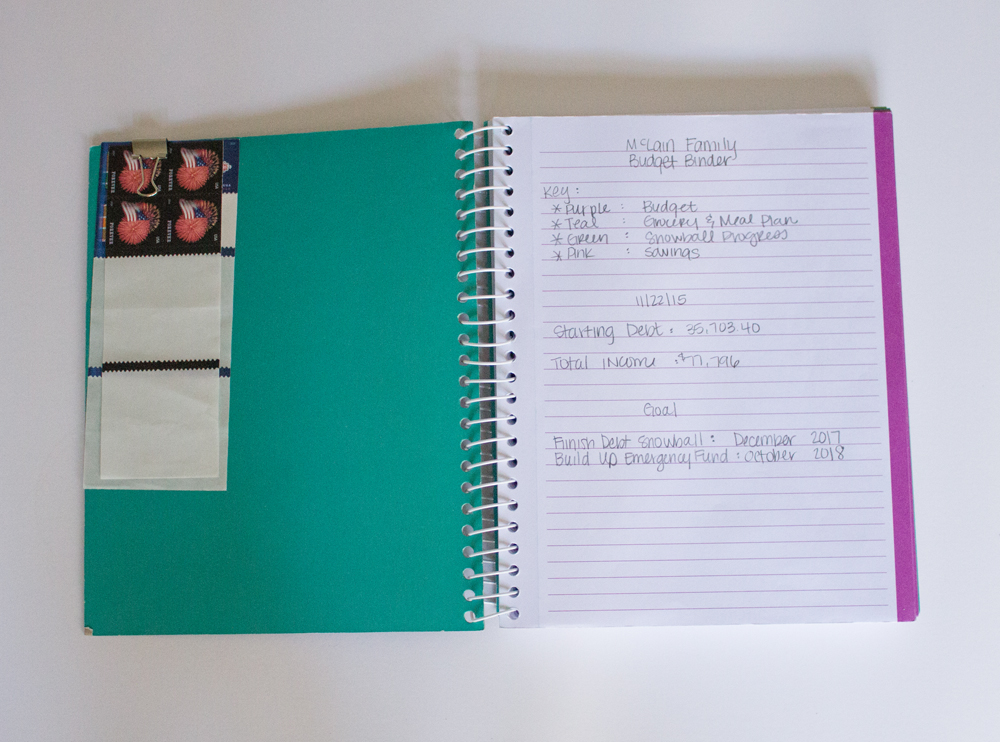

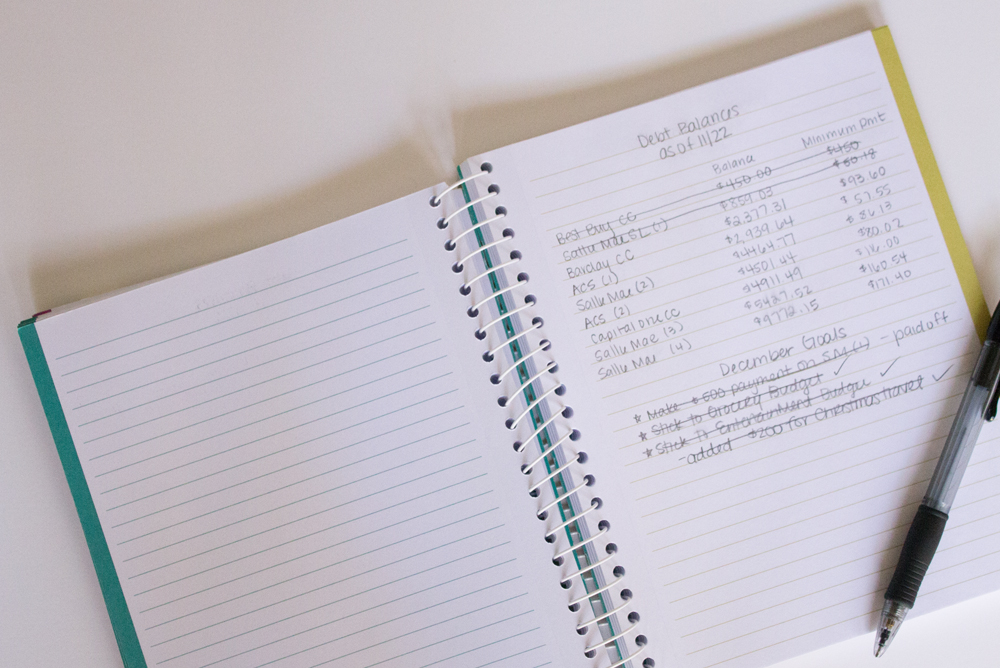

Get Some Colorful Tools

My “Live With Intention” notebook was a gift from someone and I’m so glad I hung on to it – we have had it for about three years! I can never seem to find a reason to not need a pretty notebook! Anyways, it is perfect for this because the cover reminds me to choose to be intentional every day and the inside is color coded! This is our budget notebook and everything money related goes down in here. Our debt snowball plan & timeline is listed in here, our monthly budget, budget meeting notes, goals, and even our grocery list and master price list is in here. If there is any question about any kind of money in our house, the answer lies in this book. It is fun for me to keep track of everything because it is all nice, organized, and fun to look at! Score one for Skye!

Talk About Things You Want During the Month

Chris and I have made it a priority to take care of the things that we need first and to talk about things we want later. In January, I had a haircut scheduled that I could have easily cancelled and just dealt with my hair. A haircut is not really a need – and for me that means I’m not going to die if I don’t have one. Now – I will definitely be really cranky about my hair but it is not a life or death decision. But I really wanted it! So we talked about it, added it to our budget, and allocated the cash for it. Chris wanted to keep his subscription for Bowhunter magazine going and he really enjoys reading it (and it is pretty cheap at $10/year) so we added it in to the budget and renewed it.

Living on a written budget does not mean getting rid of all the fun expenses! It means planning ahead for them, being intentional about where your money goes, and prioritizing the ones that are really important to you. It is more about making smart, planned, intentional choices with your money than just spending willy-nilly on things that weren’t part of your plan.

Plan with The End Goal in Mind

Every financial decision we make is now openly discussed between two people who are on the same page financially and have the same end goal in mind. Would I love to be spending money on a new outfit once a month? Well, no if I’m being honest I would rather have $100 every month to shop with wild abandon at Trader Joe’s. But that does not align with our shared end goal, which is to get out from underneath our student loans so we can start saving for retirement. Everything is pitted against that and when you look at it with a long-term point of view, $100 worth of food from Trader Joe’s, no matter how delicious it may be, does not make sense.

Have a Treat!

We have only been out to eat twice in the last 45 days. TWO TIMES. Somebody pinch me. That is a big deal for us because we love to eat out and it is so much easier to grab something on the way home than cook a meal, eat it, and clean the kitchen afterwards. I have to say, I am pretty proud of us for this! So, in that light, we always like to indulge ourselves a little bit for a budget meeting. And by this I mean, we get a shake from Sonic or grab some yogurt or maybe have a few cookies from the grocery story bakery. It is always $5 or less but it is something sweet to look forward to during the meeting!

Celebrate Afterwards!

Chris instilled this part of the plan and that is to always, always, always get naked after our budget meetings. Being married is so hard even on the really good days, and when you’re shoveling yourself out of a mountain of debt, you can sometimes lose sight of other important things, like laughing together, exercising, and being physically intimate. This plan to get debt free has made us so much closer in all the aspects of our marriage – and because Chris suggested that at the very beginning, it is also bringing us closer together physically! Score One for Chris! (yes, pun totally intended.)

I’ll be back tomorrow sharing a peek at our budget and debt snowball so far! What are some of your tips for monthly budget meetings?

Are you stuck in a rut with your finances? Do you constantly feel overwhelmed by money problems? Do you feel like you can never get a handle on your money? Let me encourage you to take my five day challenge to jump-start your financial goals! You’ll learn:

1. How to really feel your money

2. How a cash flow plan can set you free

3. How to set long term and short term goals

Plus learn how to evaluate your income and make it work harder & smarter for you!

Yes! Send me my Five Day Money Makeover Challenge for Free!!

Are you stuck in a rut with your finances? Do you constantly feel overwhelmed by money problems? Do you feel like you can never get a handle on your money? Let me encourage you to take my five day challenge to jump-start your financial goals! You’ll learn:

1. How to really feel your money

2. How a cash flow plan can set you free

3. How to set long term and short term goals

Plus learn how to evaluate your income and make it work harder & smarter for you!

Haha! I loved that ending. Yay for your husband being such a trooper. It's really hard to get my fiance on board with me and my spreadsheets (#nerdsunite!) but I try.

I had to do all the long-term work (like, if we do this and this now, look where we will be at 55!!!) to really get Chris on board! But it is good that you are starting out before you are married for sure. If we had started then, we would already be out of debt and our lives would be so much better/different!

Such a great post! Love organisation like this 🙂 thanks for the great tips!!

Megan McCoig

http://Www.lifewithmcm.com X

Thank you for stopping by!!

What a terrific idea and one so many couples struggle with. Good to keep the lines of communication open so there's no fights later.

Yes the budget meetings have been absolutely essential to our success thus far!! It is good for Chris to see why we need to do things they way we do and I need to have a plan because, well I'm a nerd! 🙂 lol!

Lucky for me, I am married to an accountant, so he's ALL OVER our budget. He keeps us in check for sure.

That is awesome!! It is like being married to an accountant with me! lol! Thanks for coming by!

I need to get back on a plan. I read Dave Ramsey's book years ago and got so much out of it. It worked as I paid something off BUT I only did it for ONE bill, now I should do it for our whole budget 😉

Girlfriend GET ON IT!!! It will change your life! I'm rooting for you!!

I find it so difficult to understand and as a result I get lazy when it comes to budgeting and this month I am really off my organization game. I don't know why!

We went through the same thing a few years ago when we first started too!! Budgets are hard for some people to put together and it makes it super overwhelming! Have you tried YNAB or Every Dollar? They are great tools to help get started! 🙂

I love to make lists and plan things, so I really like your idea. Also – a reason to get another adorable notebook. I love notebooks. Anyway, usually we make plans about our monthly budget, we talk about it, but we never write it down – I think it's time to finally start doing it! Thanks for sharing!

I talked about my notebook obsession on Periscope yesterday afternoon! 🙂 Writing it down is so key for me. I'm a pencil/paper type of gal!

My husband and I discuss our finaces always and having a budget really is a great preventative measure to take to lessen the chances of debt and money issues putting stress on a zrelationship.

Yes!! Having a plan for your money before you get it has been so helpful for us!!!

I really need to take a page out of your book! We are on the "same page" but the hubby and I have these conversations on the fly and never seem to write anything down so we can look at how far we have come. We too are trying to get debt free and up our savings so this would be a great way to show our progress! You have the neatest handwriting too!

When we started Financial Peace university is when we started having an intentional planned meeting. I put it on our shared google calendar and send him an invite to make it "official". Also having a little treat helps make it a little more fun and something to look forward to rather than dread! Thanks for stopping by Heather!

Mu hubby and I are in the middle of revamping our money strategy. We need to save for some bigger expenses, so we need to change our current spending patterns. While these meetings are not that much fun, they make me feel so accomplished. Love the celebration!

I love the feeling of accomplishment after planning out our month! Thanks for stopping by!

I am the nerd as well – which is funny because my husband works in Finance 🙂 I think that he gets so full of dealing with the business spreadsheets that he doesn't want to deal with ours, so I handle it 🙂 We are working Dave Ramsey too.

I am a total nerd! 🙂 I can see why your hubby wouldn't want to keep up with it at home – spreadsheets make my husband's eyes all glassy lol! Thanks for stopping by!

This is so awesome! I am newly married and we have been talking about setting up a budget so that we can manage our money better. I really like the idea of having a regular meeting. It's a great way to make sure you are on the same page and be able to talk about strategy and decisions for the next month.

Hey Jenna! Congrats on your marriage! A regular meeting has been so important so we can keep our goals aligned and make sure we are on the same page! It has made a huge difference in our finances and our marriage!

I'm so bad at planning my budget, mostly because I'm bad with math and also because I don't always know what the month will hold. I like the idea of planning it a month ahead and really giving it some thought. Plus, who doesn't like to reward themselves for a job well done.

Planning a month ahead makes it so much easier!! Plus it takes a few months to get it right – it will never be perfect the first month. Just keep doing it and you'll get it! 🙂 Thanks so much for stopping by!

Great post and great tips! Planning is key to a happy life and it starts from here. Thanks for sharing

Thanks so much Amy! Thanks for stopping by!

We have had several budget meetings over dinner with drinks. My husband deploys a lot so our budget meetings tend to come before deployments to keep us both on track when we're apart. I love your tips and will be putting some of them to use in the future!

Sometimes our little treat is a drink – I splurged last week and got a fancy bottle of wine! 🙂 Thanks so much for stopping by!

I appreciate the old school style of doing it by hand. It can get out of control easily & be stressful. These are great tips!

Thanks Kimberly! I am a total pen + paper kind of gal. It gives me so much pleasure to write it all out and then see it happen! Thanks so much for stopping by!

It's always best to keep the communication line open. These are very helpful tips.

Thanks so much for stopping by!

Budget meetings are so important, no matter what shape your finances are in! We started on the Dave Ramsey path a few years ago, and it changed everything for us. And the nerd in me likes a good pen and notebook for organizing the budget in too! 🙂

I didn't realize how important they were until we had our first one! It took forever simply because we didn't realize how much we had to discuss! They are getting faster the longer we do them! Thanks so much for stopping by!

My husband and I have been getting more serious about our budget. I love the idea of a budget meeting!

Budget meetings have been essential for us on this journey! Thanks so much for stopping by!

Can you believe that I did the Dave Ramsey course and I don't really do most of the things he said to do. I will have to really start following his advice and budgeting was definitely one of the things that I need to do.

Hey Amanda!! We started it a few years ago and tried to put our own spin on things and it just didn't work! We learned that we have to stick to his principles and baby steps for it to work for us! You can do it girl!!

These are fabulous tips! It's so important to be on the same page with your spouse regarding finances!

It is so so important!! Thanks so much for stopping by!

We became debt free in the last 18 months and it feels AMAZING. Definitely respect that you're saving and budgeting because we've been there, it works, and it's so worth it!

I can't wait to be debt free!!!! I'm so excited for you!! Thanks so much for stopping by!