Learn how to work the Dave Ramsey Baby Steps no matter what your current financial situation is! They’re a great way to set up a great financial foundation.

When most people hear about Dave Ramsey for the first time, the initial impression that they get from his that he is strict about not spending any money so that you can get out of debt. This is definitely one of his main characteristics for sure, but to me it seem a lot of people stop there, and never get past that one thing. The reality is, he has actually created a process that helps people achieve financial success, and paying off debt is only one step in the process. He calls them The Baby Steps and from start to finish, they really help people who have no clue what they’re doing with money (hello, US three years ago!) get a game plan for their life to manage their money, create wealth, and develop a spirit of generosity.

How to Work the Dave Ramsey Baby Steps

I recently received the following question from one of my readers and I thought it would be a really great basis for a blog post on this very subject, because it is one of the more important lessons that I personally learned from taking Financial Peace University and following Dave Ramsey’s Baby Steps:

“I wouldn’t say that I have a struggle with money. We have an emergency fund in place and $200.00 a week out of my husbands check goes into a savings account that we rarely touch. It’s only him and I so no kids. We are not bad with money but we do our share of spending. We don’t have any credit card debt or car payments. Just our house payment and the normal monthly bills but I still feel like we spend too much. My question for you is how do you figure out what is too much. We are not in debt and if we use a credit card we pay the balance off monthly. Also do you just put money in a savings account or are there better ways to save? Right now our money just sits in a saving and it hardly makes any interest.”

Here is why I love the Baby Steps: no matter what you have going on financially in your life, you can fall back on the baby steps to figure out what to do next. Probably best to start at the beginning and explain what the baby steps are exactly.

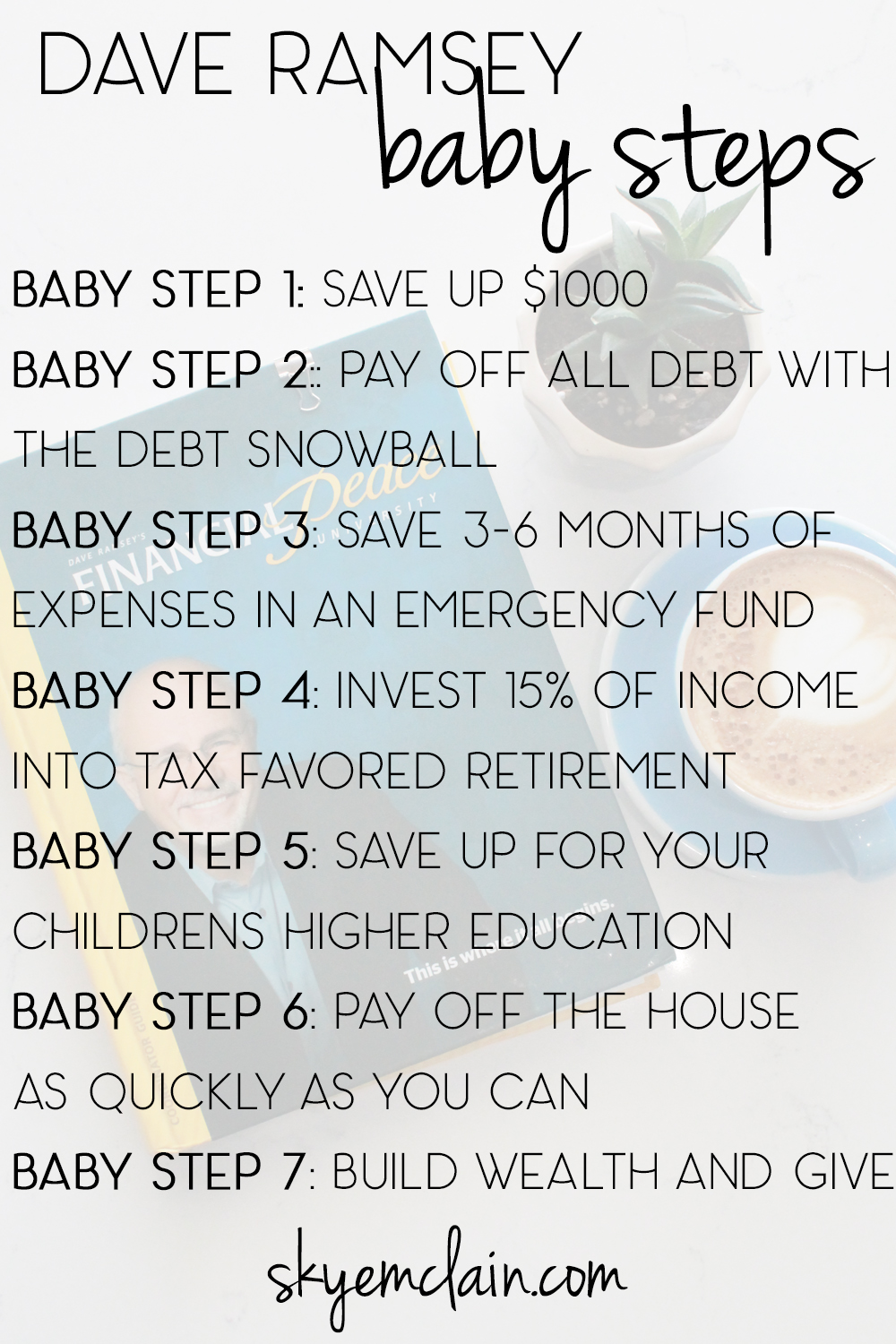

Dave Ramsey’s Baby Steps

Baby Step 1: Save up $1000 in an emergency fund and DO NOT TOUCH IT unless you have an actual emergency. (Dinner out with friends is NOT an emergency)

Baby Step 2: Pay off all consumer debt aside from your mortgage (or the mortgage you may have on rental properties) using the debt snowball or debt avalanche method.

Baby Step 3: Once you have all of your consumer debt paid off, save up 3-6 months of your income into an emergency fund, adding it to the initial $1000 you saved up.

Baby Step 4: Start saving 15% of your household income into a tax-deferred savings plan for retirement, like a 401k or IRA.

Baby Step 5: If you have kids, begin funding their college education into an ESA or 529 plan.

Baby Step 6: Throw as much towards your mortgage as you can in order to pay it off early.

Baby Step 7: Once your home is paid off, max out your retirement savings, build wealth, and give a lot of it away.

A few notes:

Before doing Baby Step 1, you need to make sure you are caught up on all essential bills. Make sure your mortgage or rent is paid up, all of your utilities are up to date, your car note, insurance, etc. If you’re in dire straights, this might take a couple of months to do, but it is important that you start at the starting line! Otherwise you’ll really never make an traction!

You should do Baby Steps 4, 5, and 6 at the same time.

If you have a second mortgage on your home, a HELOC, or a rental property that you owe less than half your annual income on, put it in Baby Step 2. Otherwise it goes in Baby Step 6.

Okay now that we have all of that covered, how do these baby steps apply to the reader question? Let’s hash it out:

Baby Steps 1, 2, and 3

It sounds like the first three baby steps covered. They have $200 each month going into a savings account that rarely gets touched and other than “normal monthly bills”, they don’t have any revolving debt that they are making payments on. As long as they don’t consider their student loans or any medical debt a “normal monthly bill”

She does ask “Right now our money just sits in a saving and it hardly makes any interest.” and to that I say – for your emergency fund that is exactly where it needs to be. You can find savings accounts that make between 1-2%, which is great for an emergency fund. An emergency fund is not an investment – it is insurance against murphy! You want it to be easily accessible in the event of an actual emergency and that means it will never make a ton of interest. That is what Baby Step 4 is for!

I would assess what it would take for you to live on for 3 months and then 6 months, and pick an amount that you’re comfortable with to build your emergency fund up to and then stop contributing to it. That is when you start working on real investing!

Baby Step 4

“Also do you just put money in a savings account or are there better ways to save?”

When you’re ready for Baby Step 4, it is time to put your money in an investment vehicle that will have a larger return than the 1-2% you’re going to get from having it in a bank. You need to find an investment professional that you trust who can explain to you how investments work and what you need to be investing in for your retirement and future! Putting money in a simple savings account that yields very little interest is safe, but with that lack of risk also comes the fact that you aren’t accumulating much compound interest either.

Look at your monthly income, and pick somewhere between 10-15% of it to decide you’re going to invest in a retirement account If you or your spouse has benefits that include 401K at work, start there until you meet whatever your company matches. Then move to a Roth IRA, to finish off the rest of your savings, up to $5,500/year if you’re under 65. If your 10-15% is more than those two things combined, you can either go back to your 401k and finish it off there OR purchase low turnover mutual funds to invest in.

(Disclaimer: I’m literally just quoting Dave Ramsey and Chris Hogan here. I’m NOT an investment professional and my words should not be taken as financial advice from a professional. Find someone who handles investments and get your real advice from them!!)

Baby Step 5

She mentioned that she has no kids, so she could skip this step! Once you’ve started invested in your own retirement accounts, then you start saving something towards your children’s higher education. Depending on your monthly income and how many kids you have, you should talk to your investment professional and see how much you should invest in order to meet the market value of an education by the time they have graduated high school and will need it.

Do I have to cover their ENTIRE tuition? This is completely up to you and your family! If you have seven kids and make an average income of around $55K a year (which is the average household income in the US), then chances of you being able to save enough for all of your kiddos to go to college on your dime is almost zero. But guess what – while you’re working these baby steps, you’ll also be teaching them how to handle money, and reminding them that they may need to plan on being responsible for paying for their schooling as well! Scholarships, grants, and a good old fashioned J O B are NOT off the table!

Baby Step 6

Again – this is unclear in her specific situation – but if you own your home this is when you start to put all the extra money in your monthly budget towards paying down your house in order to pay it off early.

Most people who follow these baby steps tend to pay off their home in an average of seven years. Can you even IMAGINE having a completely paid for home in seven years? How amazing would it be if you had no rent payment and no mortgage payment. How fast could you save up for college then? Or a vacation? Or an investment property? Incredible right?

Baby Step 7

This is the dream my friends. Chris and I can envision ourselves at baby step seven because we have some really big goals and plans when we get there! No house payment means that we can save up our retirement faster, go on vacations and pay for our friends and family to go with us, and donate more of our money and time to ministries that we believe in!

So, I want to circle back to her original question and give her a concrete answer here.

First, you need to make sure that you are making a budget every month and telling your money exactly where to go. I would imagine that they would find out they’re spending more than they think and could be doing some more saving and investing than they already are! Then I would encourage her to check with her husband’s employer and see what kind of retirement options are available and to ensure they’re funding those retirement accounts so they can get better returns on their money! And finally, I would encourage them to get busy paying off their home if they own it, or save up to buy a home if they don’t. Getting rid of a monthly rent payment/mortgage is a great way to free up cash every month and it sounds like that is a great goal that they could work toward!

The Baby Steps are covered in length in Financial Peace University – Dave’s nine-week program on how to set yourself up for long term financial success. Our church is starting our fall session of this on Sunday (September 9th) and if you’re interested in joining us, you can register for it here! Or if you want to just come check it out, you can come to the first night for free, no strings attached!

Find more information on Financial Peace University here!