FRIENDS! I can’t believe we have been debt free for an entire year!!! (Well, almost, technically the anniversary is on Saturday the 13th, but we are celebrating early!) Happy One Year Debt Free Anniversary to US! I thought it would be fun to do an update on what has changed since we became debt free, where we are now, how our goals have changed!

One Year Debt Free Anniversary

First of all, let’s go back in time a bit, and watch the video of us paying off our final debt! (I am so thankful for smartphones so we can record this kind of stuff!)

We were SO excited (despite me having to coax my husband into it in the video) because we had honestly worked SO hard on this goal for 22 months. For those twenty-two months, we had said no hundreds of time, eaten chicken nuggets and macaroni and cheese for numerous meals, paid cash for EVERYYYTHING, and basically had given up everything that took our eyes off the prize of getting that debt out of our lives forever.

In short, we turned into gazelles. And, going back, I would do it ALL OVER AGAIN. (I mean, I would never go back into debt like that again, but I would make all the sacrifices again to get out of debt). We have never felt more freedom and relief in our lives than we do now that we have no debt. It is honestly like a chain has been cut off our necks and weights have been lifted off our chests!

So, what does life look like now that we are debt free?

Well, to be quite honest, it is not a lot different. Let’s get into the details:

The Budget

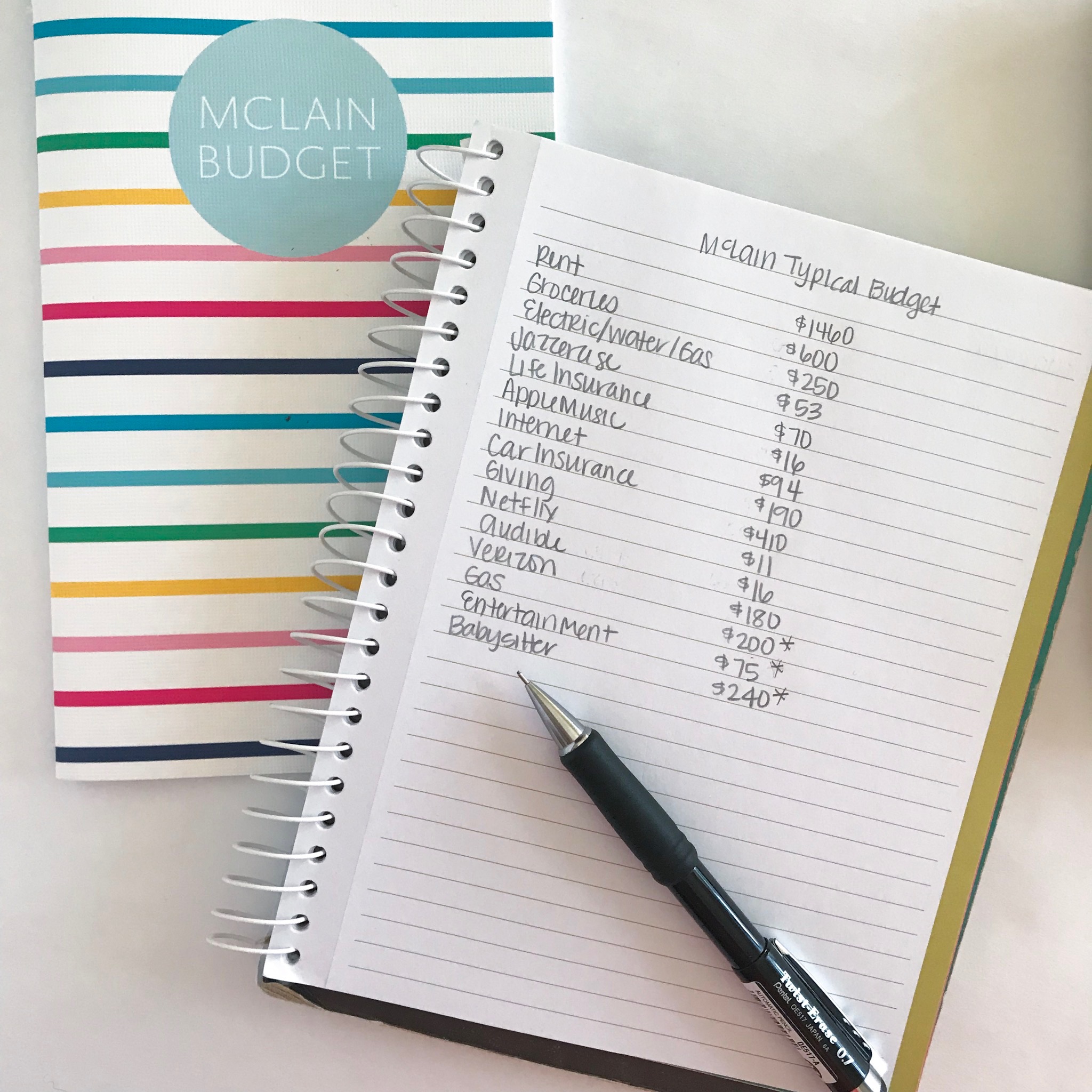

Our budget has not changed a ton. We still try to keep things to the absolute minimum because we definitely learned on this journey that there was a lot that we didn’t really need in our lives, debt free or not. So we don’t have a lot of extraneous expenses on things like cable and eating out, so as far as our monthly living expenses go, that hasn’t changed a lot. We also put Jett in Kindergarten, which means that (hallelujah, praise the Lord!) we got a big raise there since we don’t have to cover childcare anymore! Here is a basic look at our budget these days:

We also still have a budget meeting every single month and decide before the month begins exactly where our money will be going for the month. Since I am the spender in our relationship, the budget meetings are essential so that I have something to be accountable to. It is very easy for me to overspend if there is no plan in place, so I suspect we will be having a budget meeting on the last day of every month from here until eternity.

Cash Spending

While we still use cash for 99% of our monthly spending, we did switch over to using a separate account with a debit card for our groceries. This was mostly because I wanted to be able to order my groceries online and pick them up. So now, each pay day I move $150/week over to an Ally bank account and that is our grocery budget for the remainder of the pay period. While it has made my life easier to be able to spend the time I was grocery shopping doing something else, it has also made it hard to track my spending in that category.

Baby Step Three

![]()

Now that we are technically on Baby Step Three, which is to fully fund a 3-6 month emergency fund, the one thing that I have found is that it is not as exciting or easy as I thought it would be. So far we have saved about $12,000, which is incredible and I sometimes cannot wrap my head around it, but it still feels like we aren’t doing good enough. That is frustrating. Sometimes I have a hard time looking back to see how far we have come and how much has changed, and that is part of the reason I am documenting all of this on my blog – just to remind myself!

But during the last few months, we have also had to dip into that emergency fund more times than I’d really like to have. All of it was for medical expenses, which are emergencies, but I would have rather just not have had to do it. Overall, we have used about $4,000 out of the emergency fund to cash flow these expenses. So, I guess we have technically saved up about $16,000 in a year, which I am not upset about. Now, if I could just stay out of the dang hospital, that would be fantastic.

Cash Flowing Expenses

As I mentioned, we have been able to very easily cash flow a lot of medical emergencies this year, and for that I am more grateful and appreciative than ever. But we are also able to cash flow some other (more fun) stuff too! I was able to cash flow a trip to Chicago to celebrate the launch of my client’s line of Gibson clothing at Nordstrom (SO FUN!!) and we took a vacation to Nashville to do our Debt Free Scream. We could have done a lot more other things, but we definitely still had to say no a lot so we could keep funding our emergency fund as well.

PS: In case you missed the video of our debt free scream on the Dave Ramsey show, here you go:

Financial Peace University

It can be very easy to lose your momentum when you’ve finished Baby Step 2. As hard as that part is, you have this big, ultimate, freeing goal in mind and it makes it easy to stay super intense! And, when you finish that, you definitely feel like you need to let the foot off the gas pedal a bit and slow down. Dear friend, let me encourage you to NOT do that!! It is too easy to walk back into your old lifestyle now that you’ve done the hard work. Don’t let all those sacrifices go to waste!!

(Hey girl, I’m talking to myself too, so don’t feel like I’m pointing you out of the crowd!)

One of the ways that we kept the gas on the pedal in our lives was to stay involved in Financial Peace University. We lead a small group that meets on Sunday nights during the fall session and the spring session. We have gotten so much encouragement, enjoyment, and accountability from staying plugged in to that program that I fear a time when we have to give it up! I encourage you to find an FPU class being offered near you to join if you’re working through the baby steps! It definitely helped us out!

What’s the future hold?

Our big goals for the future have not changed. We would like to be able to cash flow college for Jett wherever he wants to go, retire from our careers at a young(ish) age, give outrageously to our church, and take a set of friends on a (paid) vacation with us every year.

But we won’t be able to meet those big, lofty goals unless we set some smaller, short term goals to meet first. For starters, we would really like to purchase a house soon and upgrade both of our cars. Financially speaking, this is going to require us to save up around $45,000, on top of our emergency fund. So we still have some work to do for sure. But knowing that we can put $57,000 to work in just 22 months makes it seem way less daunting.

So those are the big things from the last year since we paid off our debt. What are some of the goals you are looking forward to when you get your debt paid off?