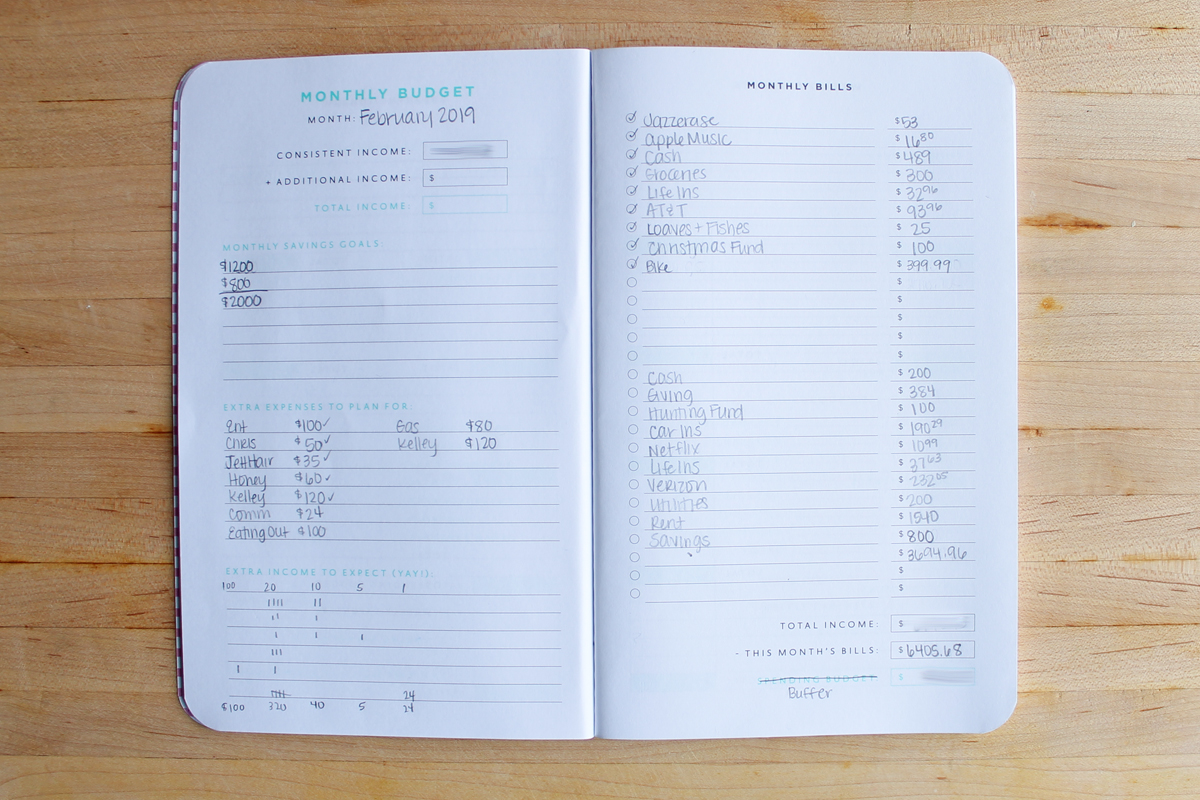

Another month, another budget update! Our February budget is a lot simpler than our January budget (hallelujah!!) and we are going to be able to meet a couple of savings goals this month and get my husband a fun toy for work! Check out the details below!

February Budget Update

February! I love February because it is the shortest month of the year and therefore the easiest to budget for. Our expenses are usually a bit lower (less grocery and baby sitter costs) but our income stays the same, so it is like getting a little bit of a raise this month!

January Recap

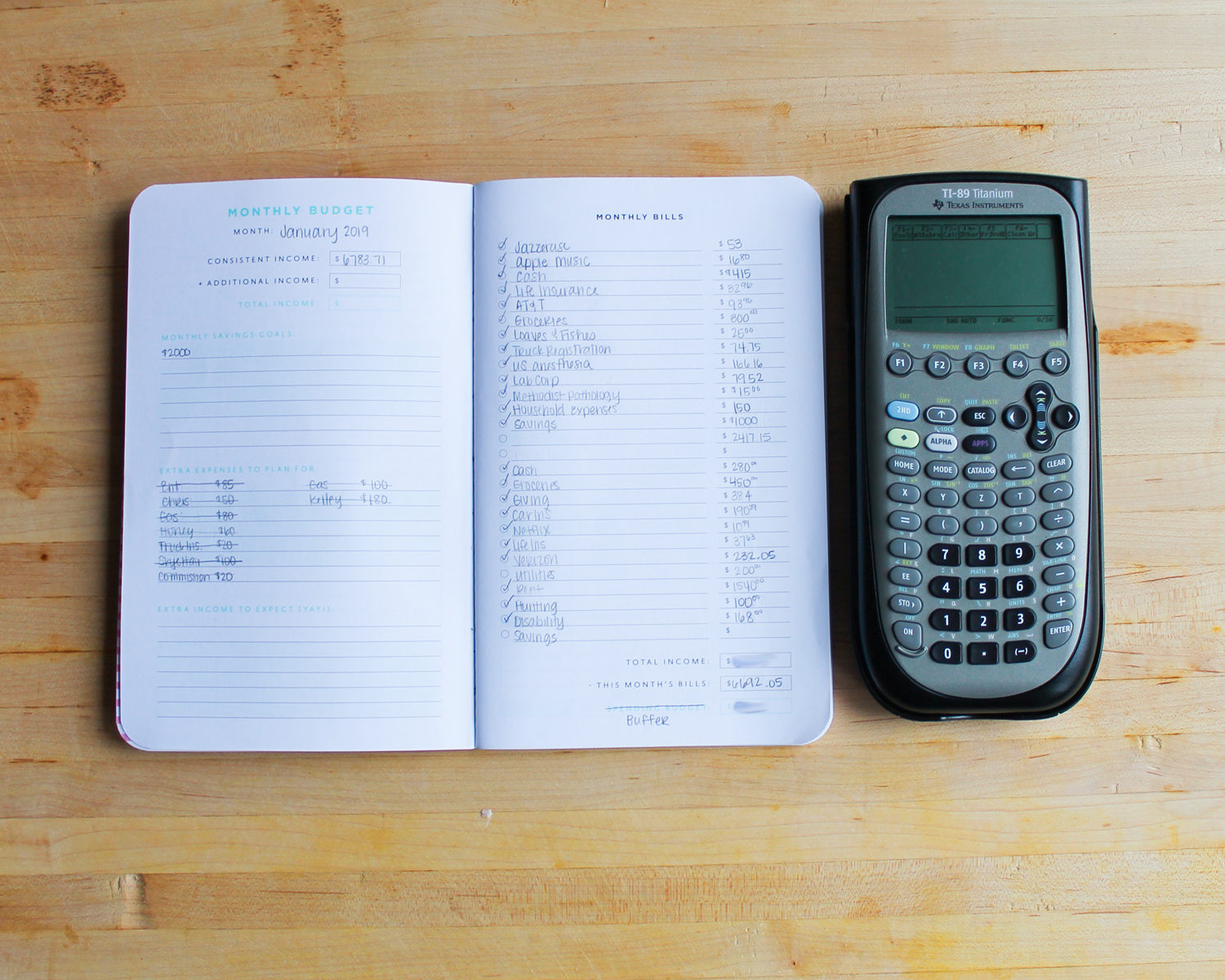

Before we go on with February’s budget, let’s do a quick recap of January. Here is what happened!

- We ended up only putting $1,000 in to our Emergency Fund, which is disappointing but still progress nonetheless. We had some unexpected expenses pop up (like running out of lunch money at school and forgetting to budget for a weekend where friends were visiting) that ate up some of our discretionary income.

- We stuck to our grocery budget ($150/week), and only used $120 in cash for gas (we usually use about $200!). When we have cash left over, I always just roll it to the next month and use it for the same category so that my cash withdrawal isn’t as much.

- I actually ended up getting a check back for one of the medical bills that I paid (The $79.52 one) because I met my deductible last year so that was fun! It ended up going toward the weekend that our friends were in town.

- Our babysitter had a couple of sick kids (boo) the last week of January so the payment for that week will roll over into this first week of February.

February Budget Plans & Goals

- My husband’s work is remodeling and they are moving his office over to another building on the other side of our church campus (which takes up a city block) and he will be over there for the better part of 18 months to two years while they finish everything up. So, especially for during the summer, we are getting him a portable electric bike that he can use to zip back and forth to the main campus for meetings and such so that he doesn’t show up a sweaty mess. (Look, it is hot here okay?)

- This month we added in an eating out category to the budget, something we have never done before. But with soccer on Saturday mornings, Financial Peace University on Sunday nights, and Enneagram Journey on Thursday nights, it will be nice for mamma to get a night off from cooking at least once a week. We have already “treated” ourself to lunch at Torchy’s Tacos after a soccer game!

- Our savings goal this month is $1,200 out of the first half of our budget and $800 out of the second half (the halves being each pay period). That would put us one month away from hitting our emergency fund goal ($15,000) and being able to start saving up to replace Chris’ truck!

- We started in January of this year making monthly deposits into dedicated sinking funds for Christmas shopping and my husband’s annual hunting trip, so we will add $100 to each of those this month.

Budget Meeting Agenda

Over the past couple of years, our budget meetings have gone from complicated meetings where I have to erase a bunch of stuff and recalculate everything in order to get our budget as tight as possible to now they take about five minutes and Chris just makes sure I didn’t forget anything!

This month we talked about the bike and how much we were willing to spend on that (I’ll be sharing more about that once we get it and he has a chance to use it!). One thing that we forgot to talk about was our giving at the church. January was the stewardship campaign month for our church and we completely forgot to decide if we were going to update that in any way for the new year. Guess we will add that to March’s agenda. Whoops!

Wait didn’t you forget something?

I know you might be thinking – wait a second – didn’t you forget Valentine’s day? The answer is no. Chris and I celebrated Valentine’s Day once, and it was while we were dating. After that we both decided that it was a Hallmark Holiday and that we weren’t buying into the hype. Not only does it save us some money each month, but it also saves us a bunch of expectations, disappointment, and resentment as well. One of the ways we show each other love is to work on our money together and that is more romantic to this nerd than flowers or chocolate any day of the week!

We do have a “School Fund” set aside with $80-$100 in that we use for stuff like Valentine’s Day or last minute random expenses like “please send a bag of M&Ms for the 100th day of school” and stuff like that. So we will use that fund to grab some Valentine’s for his class. Thankfully they are not having a party, so we don’t have to worry about getting food or snacks for that.

Guys – that is it!

This is why I love February so much. It is always such an easy month and I’m glad to finally have all of our medical bills paid off for last year too! If you’ve never done a budget before read this post before you get started! If you’ve never had a budget meeting, check out this post to help you plan for it. Let me know how your budgets are going in the comments!

Love your budget talk. I’m at the very, very beginning of getting a hold of my spending/budgeting. But your realistic dialogue is soo very appreciated.