June is here, which means summer is here! I’m sharing our June budget update today, and it is a VERY EXPENSIVE MONTH. Send help. Or money. Or prayers. Ha!

June Budget Update

I think I should really just start a June sinking fund. I honestly forget every year how damn expensive this month is, and this year it really really bit us in the behind. More on that in a minute – first let’s recap May’s budget real quick:

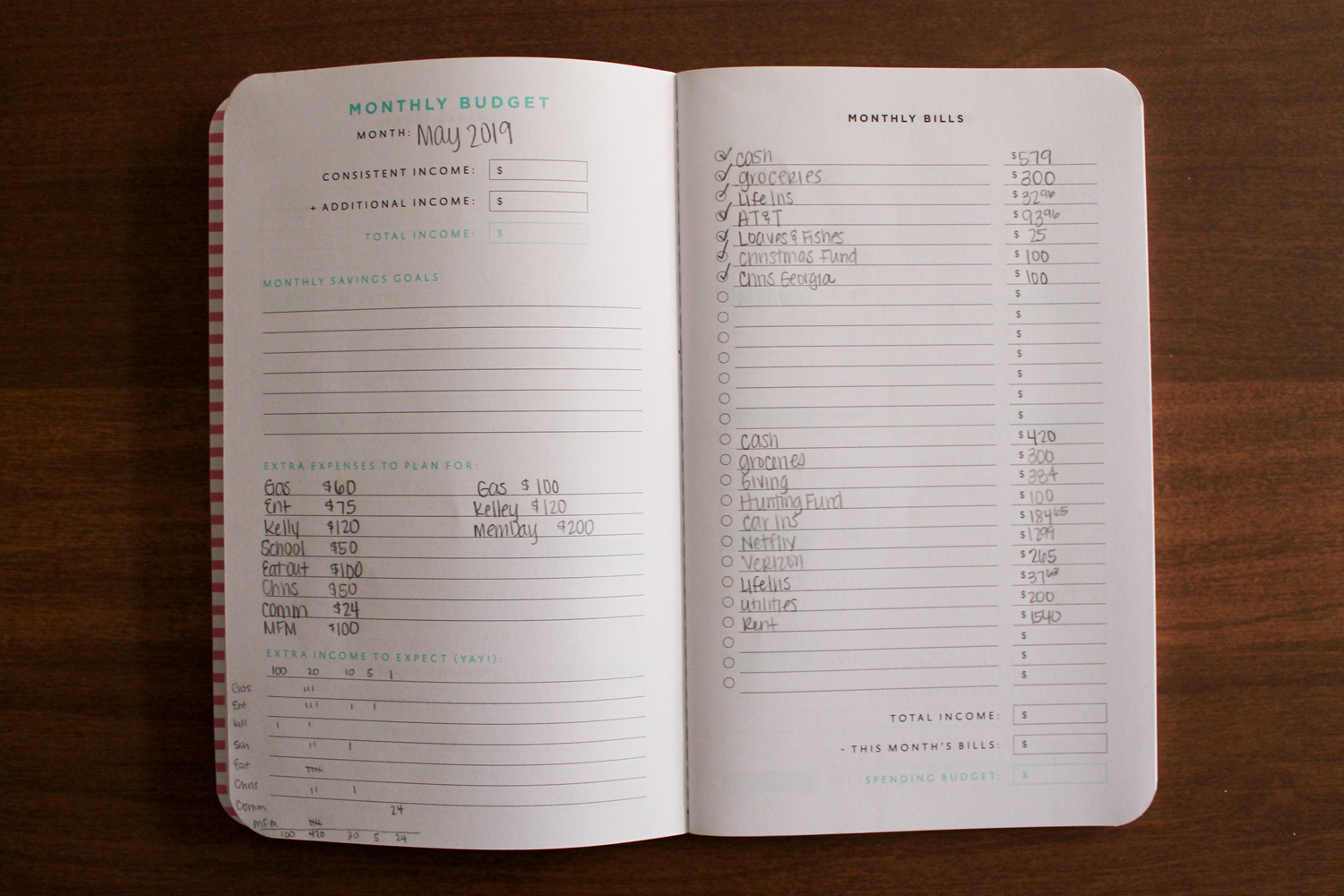

May Recap

In case you forgot, I told you last month that April was a miss overall… and guess what. May felt like a miss too! I think it comes down to three things: a lack of really being willing to say no (that is so so hard for this girl who loves an adventure), a decrease in my income overall, and missing/forgetting key things in our budget.

- One huge expense that really took a hit on our budget was my quarterly income taxes. They are $812/quarter this year. (UGH PUNCH ME IN THE GUT WHY DON’T YA) and for some reason that just seems really high, and really hard to do. But my accountant does my estimates for me so I have to trust that she is right. I had to make my first quarterly payment in may (it was due in April, but we paid our 2018 taxes instead).

- I had my debit card number stolen midway through the month, and someone decided to order $300 worth of Chipotle on my behalf in Denver, CO. (In case you forget, I live in Texas, and I’ve never even been to Colorado!) So that has put a hold on that money until my bank gets the charges worked out and taken off our account. While it is not a HUGE issue, it is a pain in the butt to have to wait it out.

- One expense we were NOT expecting, and didn’t really get any notice to plan for, was that Jett had an appointment with a pediatric audiologist, and our insurance does not cover that. So about three days before the appointment we got a call from the office to let us know that the entire appointment would need to be paid for at the time of the appointment and out of pocket. There went another $400 (but more will be coming on that in the next months).

- Our emergency fund remains at a standstill – we didn’t put any money in there in May because of my quarterly income taxes – so we are still right around the $12K mark. So disappointing, but I’m not going to let it discourage me too much. This is life, this is how things work, and this is why you should do a new budget every month. Things change, life gets crazy, but we will still stick the course until we get it done.

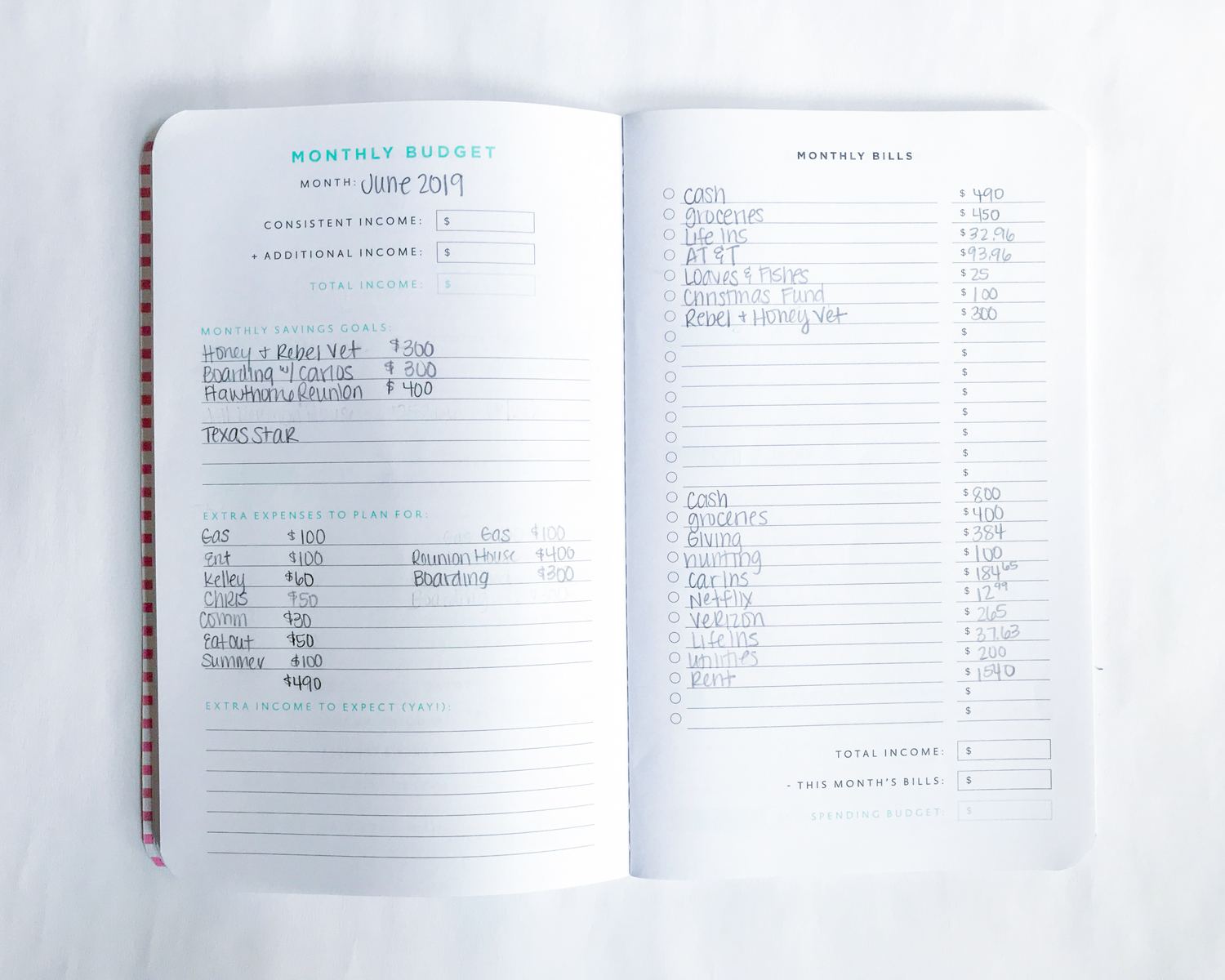

June Budget Plans & Goals

- The bad news is that we are starting this month with me making another quarterly income tax payment. So a majority of my June income has already gone to that. It just feels like another stick in the gut to send that much money to the government but that is just how it is. Maybe we will get some of it back next year? Who knows. Anyways – dwelling on it and complaining definitely doesn’t make it feel any better!

- My goal again this month is to STICK TO THE BUDGET, and it should be easier because we literally have ZERO wiggle room in this month’s budget. We have one family reunion happening this month, and another July 4th weekend that we have to finalize the payment for this month. Between those two large expenses, as well as annual checkups for the dogs, that is all of our extra income for this month gone. It is likely there will not be another deposit in the emergency fund this month. Sniff sniff.

- My other goal this month is to not let the “summer boredom” get to me. As a seven on the Enneagram (more Enneagram talk here), boredom is something I avoid at ANY and ALL costs, and as you can imagine, that can be devastating for a budget. We have some “Summer” money set aside but I tend to easily justify almost any cost in the name of fun or adventure, so I’m working really hard to keep that part of me in check.

- It is also worth nothing that I completely missed one HUGE event in June on our budget – Louisiana Annual Conference for Chris. He goes every year (so it is not like this is our first time needing to plan for it) and it is a pretty expensive week. Thank goodness we started a sinking fund for his annual Hunting trip because he will have to use that for the week and we will have to reimburse it later this year.

Budget Meeting Agenda

Our budget meeting this month was honestly kind of depressing. I know that it is a GOOD GOOD thing that we are doing all that we are doing without going in to debt. Being able to cash flow pretty much everything we do is a blessing, and I recognize that, because before we would have been asking our families for help to pay bills or trying to move things around so that we could put it on my credit card. Not having to do that is life giving, but it is still hard to not be making forward progress. I feel like we are treading water big time and that there is potentially a big wave coming in that is going to take us out.

Having these monthly budget meetings has not only been good for our finances, but for our marriage as well. Summer craziness is real around here and I feel like I’m in charge of EVERYTHING so naturally, something slipped through the cracks. It is fine – neither of us remembered it, but it just reminds me that this is why we have these meetings together. We don’t just talk about money – we also discuss our social and work calendars, plan for upcoming expenses together, and get a chance to catch up.

Now that I write all that out, it might not be a bad idea to start having weekly budget meetings during the summer so we can keep it all on track. Chris – thoughts? Lol!

That is it for June!

It is when things get really expensive or costly that I truly appreciate how much I have learned about budgeting over the last three and a half years. I know that when things do get crazy with our money I have something to fall back on, something that is solid and there all the time to come back to every month that helps calm my anxiety a bit.

If you’ve never done a budget before read this post before you get started! If you’ve never had a budget meeting, check out this post to help you plan for it. And of course, you can find all of our budget updates in one place to see what has happened in the past!

Let me know how your budgets are going in the comments!