We are officially on the downhill slide from summer to back to school! I’m sharing our August budget update with you today!

August Budget Update

July Recap

A quick note about July’s budget: It was a mess. That is the long and short of it. I feel like we have both really fallen off of the Dave Ramsey money saving freight train this summer and it pains me to say that. We used to be SO laser focused and sometimes I go back and read our budget updates from when we were paying off debt, and I miss that crazy girl lol! I need to start channeling here again so we can get on with our lives. I feel like we are just sitting in a stagnant place and it’s making us stink.

In case you’re wondering, I did not do a July budget update because the month just got away from me. All things got tossed to the side, blogging first, in the interest of survival. Summer has been hard, I’m not going to lie, but I feel like now that I’ve survived my first summer while having Jett home with me most of the time, I have a lot more experience for next year!

One quick win for July that I do want to mention! Jett had surgery at the end of the month to have his adenoids removed and tubes put in his ears. We had to pay our deductible and out of pocket expenses before the surgery, and we were able to pay that in full because have an emergency fund set aside! Is that what we want to do with all that saved up money? Heck no. But was it nice to be able to walk out of there knowing it was completely paid for? HECK YES. So our emergency fund took a very large hit, but it was for a good reason!

August Budget Plans & Goals

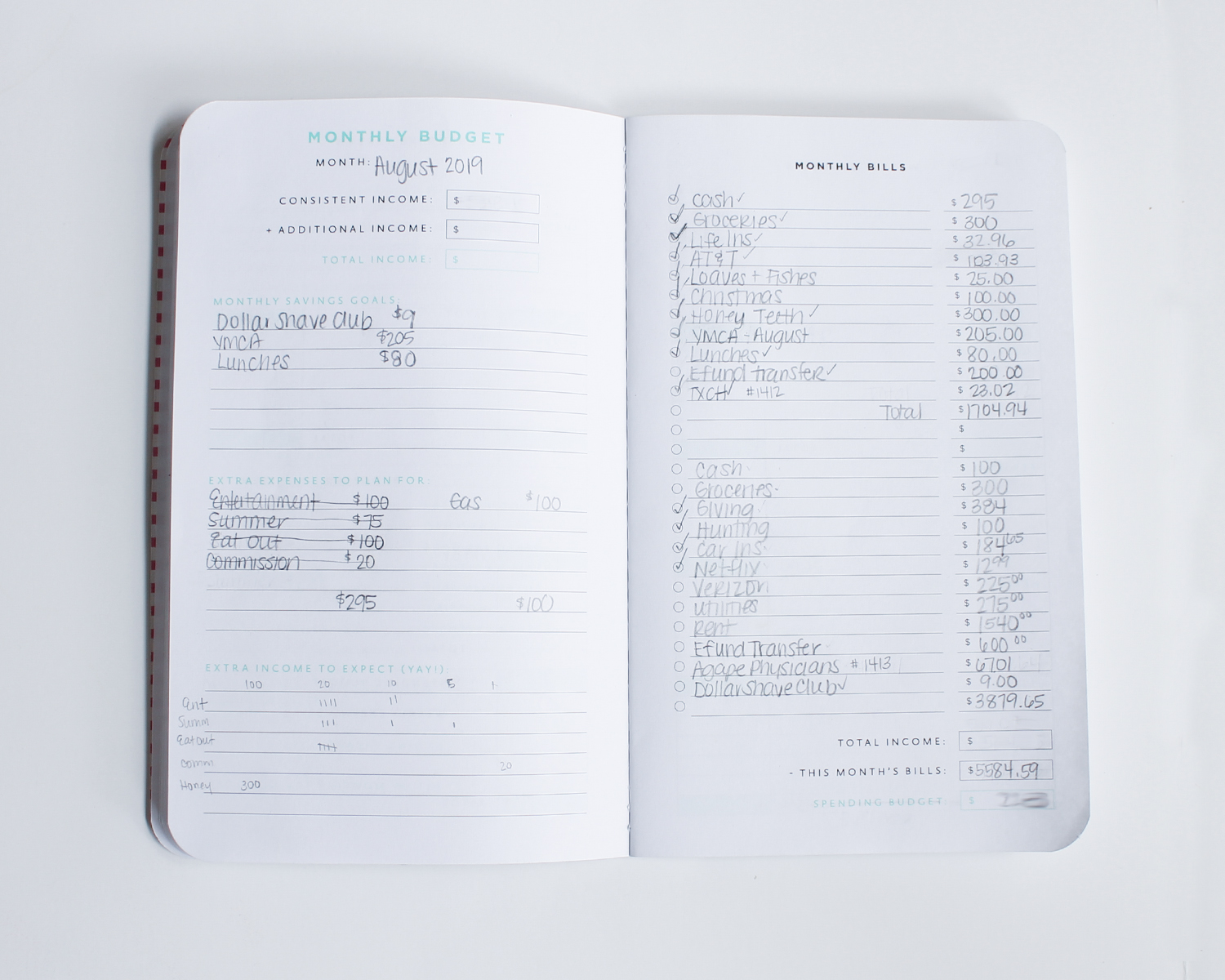

- Our goal this month is to put some money in the emergency fund. It might not be a lot, but we have GOT to make some positive movement over there so that we can proceed with our other financial goals. (I need to write a blog post about those, because maybe that would help solidify them for us and you guys could keep us accountable!) We have budgeted to put about $800 in out of Chris’ income and some, although I’m not sure how much, out if mine.

- I owe another quarterly income tax payment this month, so that is another $812 (ugh) out of my business income that I need to pay in. These taxes are killing me!

- Additionally, as of today, we have spent about $100 of un-budgeted money on doctors visits and prescriptions, since Chris and I both had a sinus infection and I had a UTI that needed to be treated with an antibiotic.

- We are saving up for Honey to have her teeth cleaned at the vet’s office next month, so we are setting aside $300 for that this month and will take the other $300 out of next month’s budget, so that is another big expense that is holding us back a bit that we really do need to take care of.

- I am very, very excited that school starts this month! I am looking forward to getting back to a routine (especially one that requires us to stay home a bit more, which always saves us money here and there) and back to having my days at home by myself! One big change that will come with that though, is that I’ll be paying for YMCA After School Care. While it is not cheap, it is not much more than what I was paying our babysitter, and this is childcare that happens every day after school, so I’m getting lots more hours to work and earn an income; the point being that I feel like it is worth it. It is about $300/month.

Budget Meeting Agenda

I had mentioned in my last budget update (in June) that maybe we need to have a weekly budget check in. While I agree that is a good idea, I’m embarrassed to say that it didn’t happen. Ugh. It is what it is, but I can’t use summer for an excuse for everything can I? Chris and I barely had time to just hang out together, much less talk about the budget.

Another line item that has been added to the budget meeting agenda is Chris’ hunting budget. We had a bit of miscommunication there – he thought we were adding way more to his hunting account monthly than we were, and it doesn’t have as much as he thought it would in there. It is enough to go on his big hunting trip this year, but it may not be enough to do any other hunting or prep work at his lease, so we have to adjust that too.

In short, I feel like a failure when it comes to our budget. Life has been fun, and busy, but also expensive and not very well organized, and it is showing in our bank account. We have not been disciplined, and I feel like a lot of that is my fault for poor planning. I know that Chris and I are both responsible for the finances of our household, but I feel like it is my responsibility to make sure it all gets done and I haven’t been diligent about that. I need to get back in my Dave Ramsey pants, for lack of a better term!

That is it for August!

Even though we are struggling a bit, I still stand by the fact that we are light years, and leaps and bounds, ahead of where we were a few years ago. We have not gone back into debt and while we are not moving forward at lightning speeds, we are NOT moving backwards, and that is something to speak of. But it isn’t enough to be able to continue down the path we want to be on!

If you’ve never done a budget before read this post before you get started! If you’ve never had a budget meeting, check out this post to help you plan for it. And of course, you can find all of our budget updates in one place to see what has happened in the past!

Let me know how your budgets are going in the comments!

Love your budget posts! Thanks for being so open about everything! I always feel like a failure when doing our budget but I hope to get better! Can you share where your planner is from? ❤️❤️❤️

Hi Shannon! They are from May Designs and I love them!