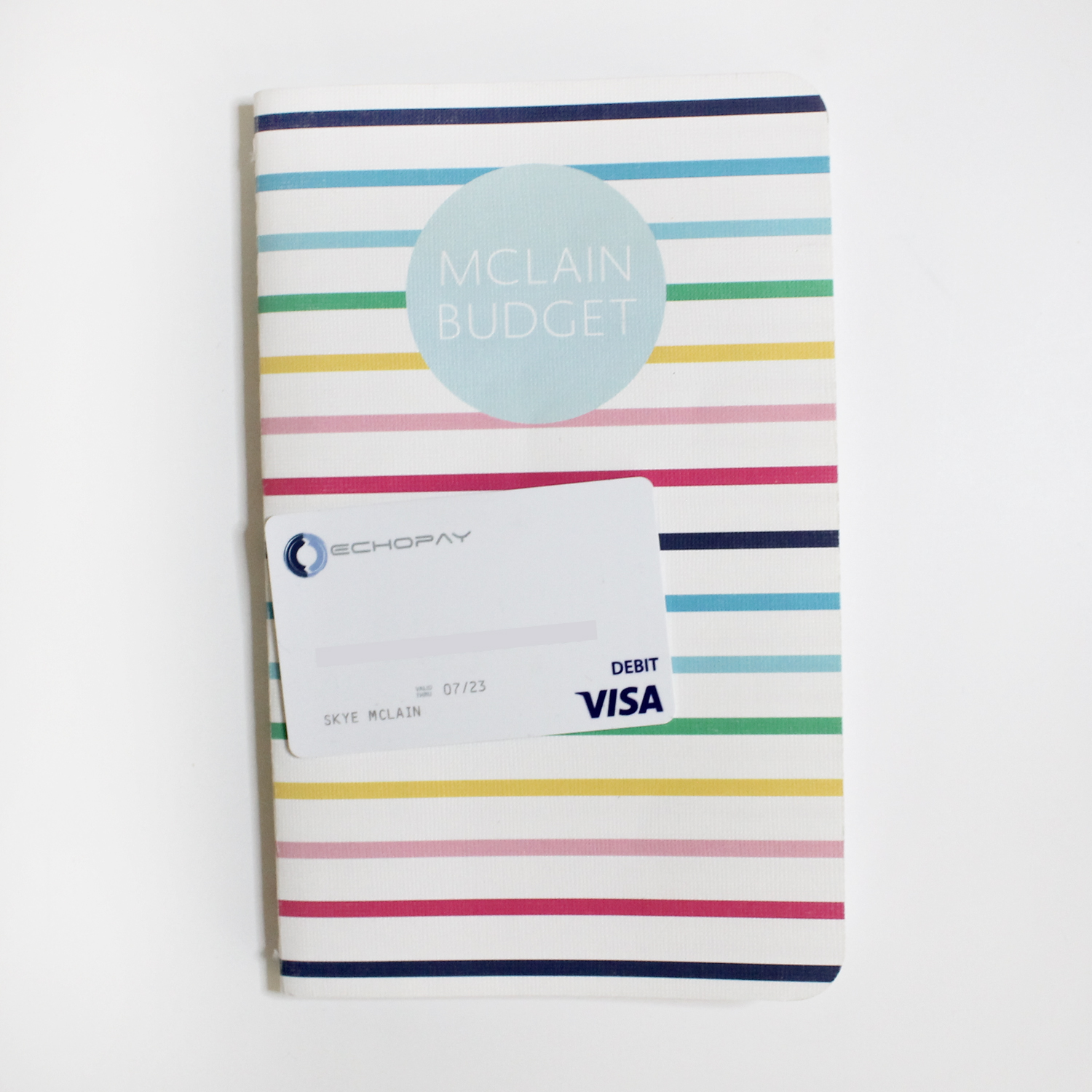

I love traveling for work! Here is how I use the EchoPay PrePaid Visa to help with my business travel planning and budgeting!

This post is in partnership with EchoPay Prepaid Visa but all opinions are my own.

One of my busiest months of the year is upon me! I have a ton of travel coming up in September which means that I’ll have a ton of business travel expenses to go with it! The good news is that they are a taxable expense. The bad news is I still have to plan for it and pay for it up front!

Business Travel Planning with EchoPay Prepaid Visa

In years past, before we got our budgeting lives together, I used what I like to call the “swipe and pray” method for almost everything, including when I would travel for business. You know – where you swipe your card and just pray it goes through or that some other payments haven’t cleared just yet so it gets approved? Yep – that was me 100% of the time.

Now, I obviously like to plan and budget for it ahead of time, so that I’m not causing any other payments to bounce like a basketball or pulling out a credit card to cover it. (Don’t have a credit card anymore, so we know that option is out of the window!). So let’s talk about how I budget first!

How I Budget for Business Travel

Generally, when I’m traveling for business related stuff, it is to go to a blogging conference or a mastermind retreat. My expenses for a trip like this generally include:

- Travel: (airfare, gas, car rental, baggage fees)

- Hotel/Lodging

- Meals

- Miscellaneous: (things like souvenirs, shopping trips, Uber fees)

The first thing I do is to figure out and account for all of the expenses that I can ahead of time. Since conferences tend to release their tickets early (up to a year in advance), that is an easy one. I usually try to pay for the conference ticket as soon as it comes out if I can in that month’s budget or set aside the money from next month to buy it. Usually tickets sell out quick, so the faster I can get it the better!

Then I immediately check into flight costs if needed, or plan out my route via car so I can see how much it will cost in gas. These two expenses are pretty easy to plan ahead of time so that I can save up for a couple of months before making these purchases. If it is a car trip, I usually set the money aside for that a couple of months in advance. But, having these big expenses knocked out ahead of time makes the rest of the expenses that month a little less burdensome.

I also like to reserve my hotel as soon as possible. That way I have the room AND I get the receipt from the hotel so that I can start saving up the money for the hotel fees. And, since I usually split a hotel room with at least one other person (hi Jessica!), I can go ahead and let them know what their part of the room is too. It gives me a few months to set aside money for those expenses as well so that the month of, I already have everything read to go! (More about where I save that money up in a bit!)

Lastly, I have to figure out how much I’m going to spend on food while I’m there. Lots of conferences have meals included – usually breakfast, lunch, and dinner. Sometimes just lunch and dinner. Sometimes none of them. It is easy to see on the website what is included in your ticket so that you don’t have to budget for those meals. For the meals I am expected to cover, I give myself a per diem for each meal and usually set that money aside the month of the traveling, because it usually isn’t that much.

For all of the miscellaneous things I usually just set aside one amount in addition to whatever Uber fees I might encounter. I use the Uber app to pre-plan all of my rides and it will give me an estimate of how much it is going to cost me. I’ll take those numbers, add in about $40 to cover tips and a surprise up-charge, and so far in my traveling that has been enough to cover me! My typical “miscellaneous” category is about $100, and I hardly ever use that all!

Protecting my Identity and Money

Another aspect I have to think about when planning for business travel expenses is protecting my identity and our personal accounts. That is where EchoPay Prepaid Visa comes in! Not only does it give me an easy way to separate all my business travel expenses from my regular business expenses but it is completely separate from all of my checking accounts so it protects them from being hacked into or stolen from in any way!

You guys all know that I’m a HUGE fan of cash. We use cash for getting gas in our cars, shopping money, eating out, fun money, etc. It has been a great way for us to stay within our budget in those categories that are easy to go over on. Plus, when you use cash, it makes you feel each purchase you make. When you hand over that $100 for a pair of shoes, you don’t get the shoes AND your cash back. (Like when you use a debit card and you get your shoes and the debit card) so you actually see and feel that money disappear and its painful! It has helped me curb my spending big time!

As much as I love my cash, I don’t like traveling with it as much. It is just too easy for me to misplace a couple hundred bucks and that just makes me nervous. I also feel like I have a huge target or a red arrow pointing at me any time I pull out cash to pay for something. “ALERT ALERT THIS GIRL HAS CASH.” It makes me feel a bit safer to pull out my EchoPay card instead.

Remember earlier I talked about “setting my money aside” for expenses a couple of months in advance? This is just another reason I’m loving my EchoPay PrePaid Visa. I deposit that amount of money on the card using their app and I’m good to go! It is like a mini savings account that I can use to stash away money for expenses like this and it is super easy to access and use when the time comes.

EchoPay PrePaid Visa

Let’s talk a little bit more about the EchoPay Prepaid Visa card! Because as cool as it is for business travel, there are a ton of other reasons to love it too!

Easy to fund: The EchoPay card is easy to fund with money! You can set up a direct deposit to fund the card from your monthly paycheck! If you plan to use it for your regular monthly expenses, this is an easy way to set that money aside every month!

No overdraft: The EchoPay card does not allow an overdraft on your account, meaning that if the charge exceeds the funds on the card, it just declines the transaction, unlike my debit card that allows it and then charges me another $35 if it happens. (So annoying!)

Low fees: The EchoPay card has a $4.95 monthly fee that is assessed for card usage. However, this fee is waived if you deposit over $1000/month onto the card! You can see a full schedule of all the fees here (which are pretty low as far as others in the industry go).

Easy to control: The EchoPay app that works alongside the card makes it very easy to immediately see what your balance is and lock your card if necessary. You can also set up to get a daily text alerting you to your balance as well so you are always in the know!

Big future plans: The EchoPay card might not be a unique product as a prepaid debit card, but what makes it unique is the direction it is headed! I am excited to see all the features that are added to the app in the future and share them with you guys as they become available!

In short, I’m really excited to be adding the EchoPay PrePaid visa card to my billfold and overall financial plan! Be sure to follow along on Instagram over the month of September to keep up with all my travels and how I’ll be using the card while I’m flying here and there!