Have you ever done a no spend month before? This was my first time – check out everything I learned from it!

Just like working out or eating healthy, keeping your finances healthy is an evolving process. When you hit a plateau in your physical health, you make a major change to break through it, right? For the first few months of this year, I was having a really hard time breaking some spending habits I have (still have them, still working through them!). So I thought it was high time that I did a no spend month to get my priorities and goals back on track!

How a No Spend Month Changed Me

What is a no spend month?

First of all, let’s talk about what a no spend month is. There are many different ways that you can define it for you or your family, but here are a couple of the most common ways that people do a no-spend month:

The “spend absolutely no money at all” month. This is the most extreme kind of no-spend month. You exist on what you have and have to make some major sacrifices to make this happen. Sometimes people do this when they know they have a big expense coming up (like a medical bill they need to pay or maybe they want to challenge themselves to see how much they can put in their vacation fund). You do your best all month long to eat what you have at home for all meals, not have to put any gas in your vehicle, and abstain from making any purchases for yourself or your home (like clothes or pillows for the couch).

The “only spend what is budgeted” month. This one is less extreme but still a challenge nonetheless. It also requires the extra step of making a budget that you have to stick to, which means that you have to think ahead for the entire month and make sure that you have everything you need to planned for. Here’s the deal though – you can’t make stuff up just so you can put it in the budget and spend the money. You should still be working on limiting your expenses and opportunities to spend any money in order to really learn from the challenge.

The “don’t spend money in this category” month. Some people just find that the need to break a specific spending addiction, like hitting the Starbucks drive through every morning or eating lunch out at school every day or clicking “add to cart” a few too many times each month. I would say that this type of no spend month is easier than the other two, but I would be willing to bet that participants in them would vehemently disagree with me. I’m not currently going through the Starbucks drive through every day, and have never really done that, so I really can’t speak to how difficult it would be to break that habit. The idea though is to pick a specific store or category that you always seem to spend more than you think you did and cut it off for 30 days.

So of the three types, spend absolutely no money, only spend what is budgeted, and don’t spend any money in a specific category, this is the one I went with.

How My No Spend Month Looked

For mine, I chose to do the “only spend what is budgeted” type. I should also insert here that this was just for me, not for us. My husband is very disciplined with his cash and never spends anything that he needs to use the debit card for. I, on the other hand, tend to spend a little here, a little there, and since I am the one balancing the checkbook every day, Chris never knew the difference. I really needed to reign in my spending, especially since I am a spender by nature, so that we can keep moving forward our Baby Step 3 goal (which is to save $25,000 by the end of the year).

The problem is that it never seemed like much to spend a little here, a little there, and then a little over there. But at the end of the month it always added up to WAY more than I thought it would be and meant we wouldn’t be putting that money in our savings account which was ALWAYS a bummer for me. I felt guilty and a little ashamed that I was moving the opposite direction of where I had agreed with my husband during our budget meeting that we would go.

I should maybe also clarify that it wasn’t always on stuff for me (I would say maybe 3-4% of this spending was on things that I wanted or “needed”). It was usually house stuff (extra laundry soap or dog food or some new special snack or treat from Thrive Market) or things for Jett (shoes, clothes, toys, special food he wanted, basically anything because he is the cutest child ON the planet). The point is that they weren’t things that we ever really NEEDED and they were not in the budget. But the spending of the money gave me a thrill – like a little buzz every time I hit checkout. All my spenders out there know what I mean.

When we made the budget I told Chris about my plans so that we could be sure that all must-have items for the month of May were in the budget – no surprises! We also set aside a separate budget for the things that we were low on (dog food, dish soap, etc) so that I could replace them as needed. I also kept my $50 “fun money” in the budget, but made a goal to not spend it, even though it was technically budgeted.

So the bottom line is that I could not spend any money on any item that had not already been budgeted for AND I couldn’t spend my fun money.

Things that helped me

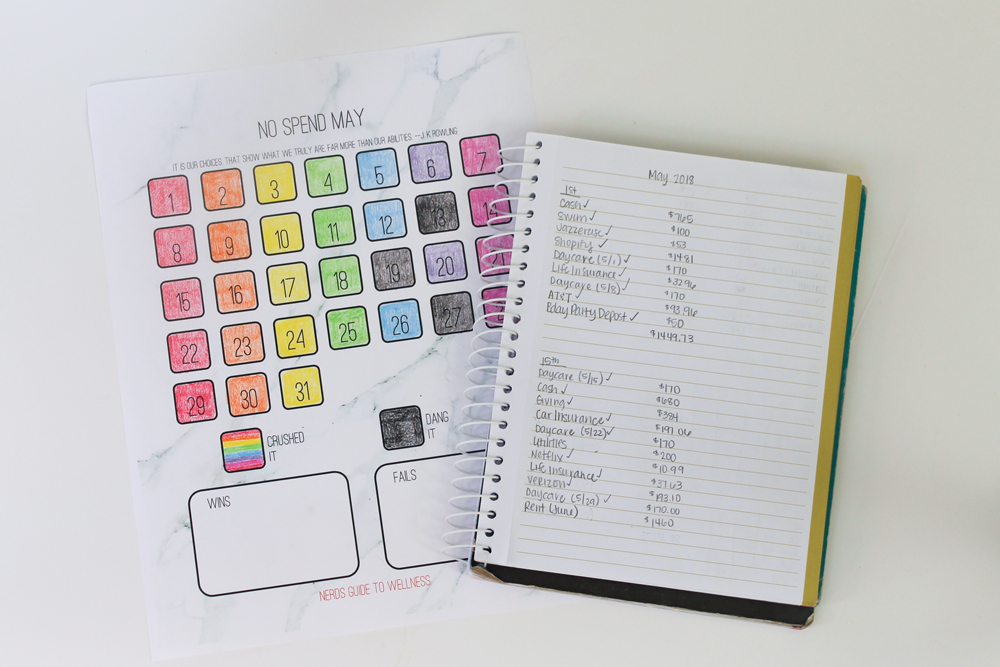

If you’ve been a reader of this blog for long, then you know that visually tracking progress is a huge motivator for me. (If you’re new here, see my emergency fund tracker and my debt snowball tracker). While I would normally make something for myself for this, I have a good friend who already does! I downloaded my tracker from Nerd’s Guide to Wellness and hung it on my fridge right over my Emergency Fund Tracker.

The way it works is you pick a color (or colors!) to color each square in for that day based on whether or not you spend money or not. There is also a notes section at the bottom where you can keep track of wins and “dangits” throughout the month.

As an additional way to help me stay on track, I decided to color the squares in on the chart in a rainbow pattern because I knew it would kill me to have to put a big ugly black square in the middle of my pretty rainbow.

Another thing I did to help me was to stay away from places that I knew would be tempting to spend money at (you know like TARGET or the grocery store or Amazon). I deleted the Amazon app from my phone and even did some online grocery shopping to eliminate those random impulse buys while shopping. I wanted to give myself every opportunity to succeed, rather then leave all these potential roadblocks in the path that could lead me astray in a moment of weakness.

The last thing I did to help me was to decide at the beginning of the month that I could definitely do this. Preaching to myself about changing my behavior patterns has been a game changer for me. If you start out the process of doing something having already decided that you can do it (rather than with the “I’ll give it a try, but I’m probably going to fail approach), you have a 95% better chance of actually doing it*.

*This is scientific research conducted at the school of Skye McLain and should be taken with more than one grain of salt.

How Did I Do?

The fact is that I spent money that was not part of the budget on three days this month. Now whether or not you want to call this a win or a fail depends largely on your perspective. I am waffling rapidly between a win and a fail… here’s why.

I know that I could have very easily gone without spending on those days, but I gave into the temptation and I set myself up for failure in each instance that could have easily been the other way around.

The first time, we were at Target, and we were only at Target to kill time. This my friends is a recipe for disaster when it comes to unplanned spending. THIS SHOULD BE OBVIOUS TO ME, since one of the places I decided to avoid was Target! I ended up buying a pair of shoes for Jett that we did not even need, but they were super cool. (And we rarely agree on shoes anymore). However, that is not justification for the spend in my book.

The second time, I shamelessly bribed Jett with donuts to get him to school. We had to miss swim lessons because he had an ear infection and he was upset, so I told him we could go get a donut on the way to school in order to get him out the door. It would have been a lot harder to motivate him without the donut, but it would have been possible. I just sort of chose the easy way out.

The third spend was on a Sunday morning, when it took a little longer to get out the door than I would have liked. I ended up buying breakfast for me and lunch for both of us at the church cafe, which was a result of overall poor planning on my part. I didn’t have any lunch ready to go at home and let’s be honest I did not want to cook anything either. This was pure laziness if I’m honest.

The point is, in each case, I could have definitely gone without spending but I chose not too, because it was the easy path. Would have it been torturous to take the coolest shoes ever off Jett’s feet and not buy them? Yes But would it have been possible? ALSO YES. Could I have gotten him to school without the donuts? Of course. But it was just so much easier to buy the dang donuts. And on that Sunday that I bought lunch for us – I ALREADY HAD LUNCH MADE AT HOME! But the thought of going home and warming it up was exhausting me, so I caved in.

I’m honestly calling it a fail, because I could have definitely gone 31 days without spending any money. However, that doesn’t mean that I didn’t learn something from it!

What I Learned

The first thing I didn’t really learn, but definitely had it cemented in as a positive yes. I am an emotional spender. When I feel like crap emotionally, I want to buy things to make me feel better. The anniversary of my mom’s death was on May 17th, and instead of buying things or eating a bunch of junk food (which I can’t do anymore either because it will make me sick) I actually had to FEEL all of the grief and sadness that was washing over me. It was a really hard day, but I made it through without buying anything or eating a pint of Halo Top. Even though that day sucked, it was a WIN.

I had to return a bathing suit (one that I bought before no-spend May started) and the woman at the department store alllllmost convinced me to just exchange it. She dug through all the racks and found the right size and drug me to a changing room so I could try it on. I felt so bad she went to all the extra effort that I felt bad for returning it and not getting the new size. But y’all – nobody else gets to spend my money for me. That was a lightbulb moment. And duh – it should seem obvious – but I realized that a lot of the time I buy things, it is because I feel guilty if I don’t because the salesperson has done their job for me. That is NOT a great reason to spend money though. Whether or not I buy it, she is going to get a paycheck. It is something I still need to work through but my goal is to not let other people dictate how I get to spend my money.

The last thing I learned was that Jett shouldn’t sway my spending habits either, as hard as that will be. He is just SO DARN CUTE YOU GUYS. This one will be the most challenging for sure!

Just scroll to the bottom?

I don’t blame you. This 2,200+ word essay is obnoxious. Here is the reader’s digest version:

1. There are three basic types of no spend months: spend absolutely no money, only spend what is budgeted, and no spending in a specific category. I chose the “only spend what is budgeted” version.

2. This meant that I could not spend any money on anything that wasn’t already budgeted and I decided not to spend my fun money.

3. I used a tracker to help me see my progress, colored it in a rainbow pattern that I knew I wouldn’t want to break, and I tried to avoid stores that I knew were easy to spend in.

4. I had three spend days, all of which centered around buying something for Jett.

5. I’m an emotional spender and feel guilty when I don’t spend money after someone has worked and done their job to encourage me to spend.

If you enjoyed this post, be sure to share it on Facebook or Twitter below or pin any of the images!

Skye, thank you for everything that you do. I truly enjoy following you. Everyday I look forward to seeing what new thing you have to enlighten the world with, including me.

You bring joy to my day,

Kimberly