Time for the January Budget Update! Friends, it has been a hot second since I shared a budget update – like, over a year! A lot has changed since then, so I thought it would be a good idea to check in with you guys and share what our budget looks like these days!

Starting in November of 2015, Chris and I started doing a budget together at the beginning of every month. We have a meeting at the beginning of every month and talk about what our plans and goals are for our money that month. So that means, to date, we have had THIRTY EIGHT budget meetings… crazy!!

While we were paying off debt, we were scrimping and saving every penny we could to throw towards our debt, so our budget meetings consisted mainly of “where can we cut back this month?” and “is this really necessary right now?” Now that we have our debt paid off, and a good chunk of our emergency fund is saved up, the budget is a little more fun and interesting!

January Budget Update

As a way to continue to be accountable to myself and to our goals, I am going to start sharing our monthly budget with you guys again! It helped me so much knowing that during those 22 months I had to report back with our progress! So here we are again with our budget!

Read how we paid off over $57,000 in debt in under 22 months!

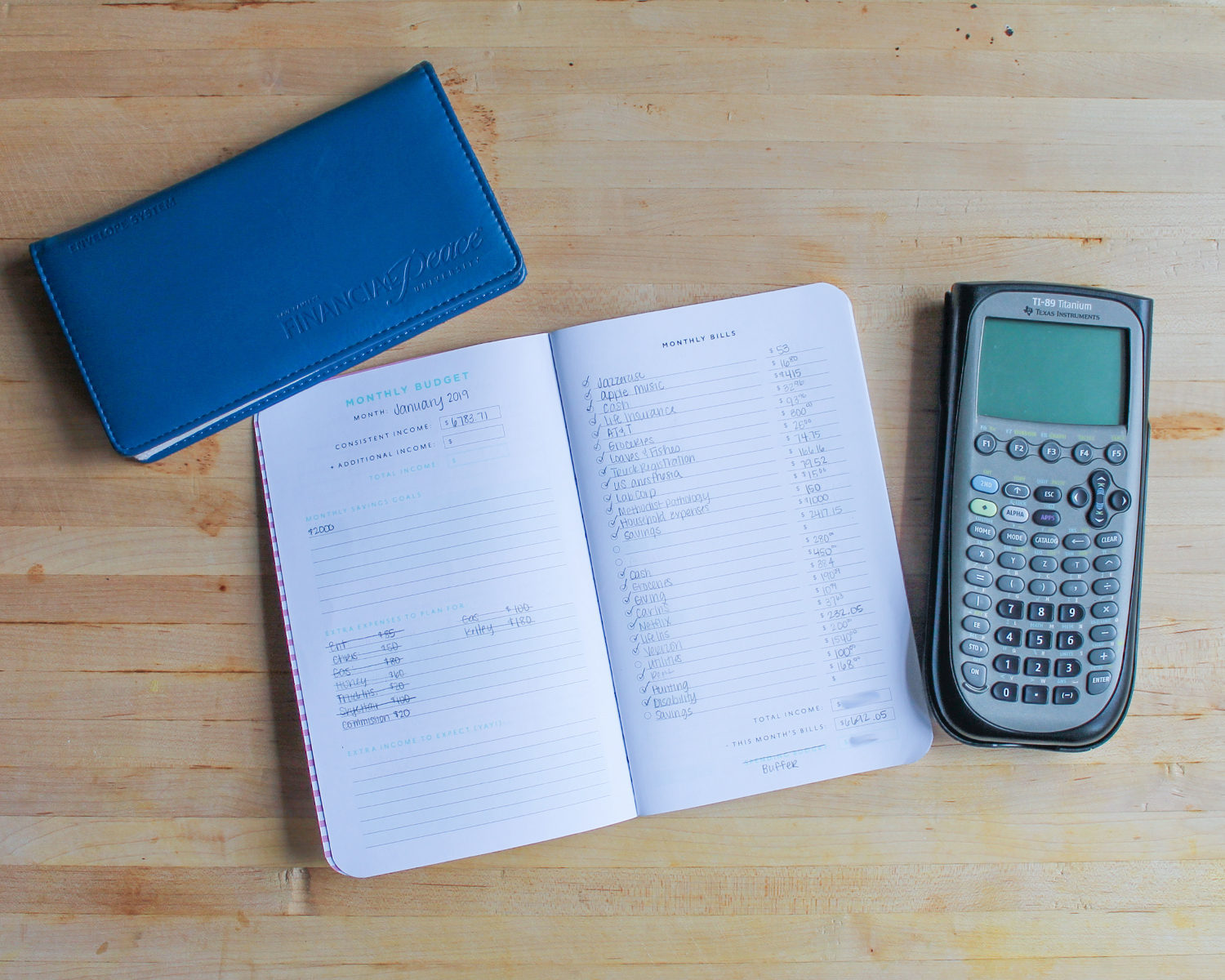

First of all, I finally got a new budget notebook after using the same one for three years! If you’ve been around, you might remember my “Live Every Day With Intention” notebook from my older budget update posts. That notebook served us so well, and I’ll honestly keep it forever because it is is literally a map of how we paid off all that debt, but I was ready for a new one to use this year!

I got this little notebook from May Designs and ordered it to match my Emily Ley planner! I love that they collaborated so that I could make that happen because matching is my favorite!!

Okay now that we have the aesthetics out of the way… let’s talk about where we are spending our money this month and what changes we have made to our budget!

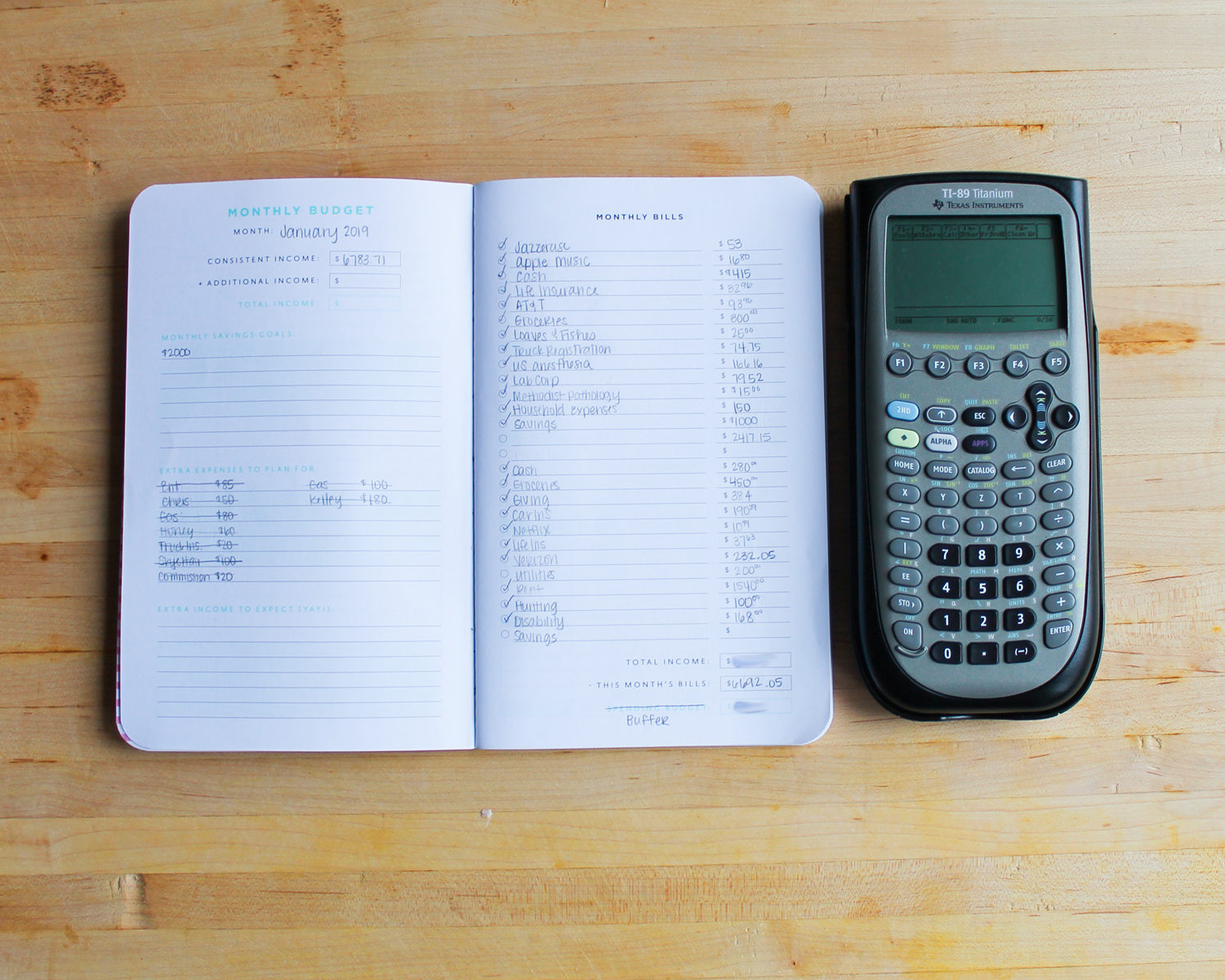

I split our budget into the bills that are due during each pay period. Chris gets paid on the 15th and 31st and I get paid sporadically, so this method works well for us. We do a mini zero-based budget for each paycheck.

I also make sure to write down each individual expense in the order it is due so that when I write it in my check register, it will match my bank account too. (Remember, matching!!) In January we had a few random medical bills from my procedure in August left to pay as well as our truck registration (one of those random annual expenses) and a line item for household expenses, that we used to stock up on things like toilet paper, paper towels, tissues, dog food, laundry detergent, dish detergent, batteries… etc.

We started two sinking funds this year that we haven’t done before as well. The Christmas fund and the Hunting fund we will be adding $100 to monthly so that when the time comes, we already have everything saved up that we will need for those expenditures. Last year we made the incorrect decision to just take those expenses out of those months and to put it lightly, it did not work. It left me feeling strapped and stressed with other expenses and quickly showed me the value of a sinking fund!

Our initial goal this month was to put $2000 into our emergency fund but that is likely not going to be happening. We did drop that first $1000 before the 15th, so I’m excited about that! But I forgot (need to add to my annual expenses list!) our disability insurance and we also reserved an Air BNB for a reunion this summer, which was not planned for but was a necessity so we could secure the perfect house. So we won’t be hitting that $2K mark but we are still putting quite a bit in the savings account so I’m happy with that!

The page on the left is where I detail out our cash expenses for the month. We are always cash heavy for the first half of the month because we go ahead and fully fund our fun money, Chris’ “work” money, and Jett’s commission fund. The second half of the month is usually just replenishing the gas fund (yes, we still pay cash for gas) and our babysitter’s fee.

So that is it – there is the budget update for January 2019! If you have any questions, please feel free to leave them in the comments below or leave a comment on my Instagram! If you found this post helpful in your debt free journey, be sure to pin it or share it to your Facebook page!

Thank you for sharing so much about your budget. I’m late to the game but committed. If this is too personal, say so. But wondering if you use credit cards at all. We currently use them for everything but pay the bill off monthly. But without a firm budget, this is a messy habit when we get a large credit card bill.

Just wondering if I can’t shop on Amazon any more…..

Hi Annmarie! Thanks for coming by!!

As far as credit cards go, we never, ever use them. I had a credit card for years and it did nothing but get me in trouble. I use a debit card or cash for everything. When you use a credit card to pay your household bills, it technically puts you a month behind – you’re paying last month’s bills with this month’s income. When in reality, you should use your income from this month to pay this month’s bills.

I’m an Amazon Prime member so I’m not the one to ask if you shouldn’t shop at Amazon anymore. What I will tell you is to make sure you have an item in your budget for Amazon spending so that if there is something you need to buy from Amazon you have the budget set aside to do that!

I hope this helps! Let me know if you have any other questions!!