Getting on the same page about our money was a marriage- and life-changing move for us! Here are some of the things we do together to meet our financial goals and some tips on working your money with your spouse!

I did a post a while back about talking about money with your spouse and that really focused on what financial things you should be talking about with your spouse. This post is more focused on what we do together, the actions we take as a couple, to stay on the same page with our money!

Working Your Money with your Spouse

It is not like our marriage was in shambles and falling apart around our money issues. Chris and I have always had a strong relationship and have communicated and worked well together (which I am insanely thankful for!). But before we started doing our finances together, it was super stressful for me. I was the one handling all of our money stuff – I paid all the bills, balanced the checkbook, kept up with expenses, made most of the major purchases, and did almost all of the stressing over our money. I carried that burden on my own because Chris had a stressful job and had to make a lot of decisions every day there, and I just didn’t want to put all of this on him too!

We both had our fair share of mistakes that we contributed to our dismal financial outlook. I am a spender and (still) struggle with making snap purchases of things that I/we don’t even need just for the rush of buying something. Chris’ job required him to be able to float between $200-$300 in reimbursable expenses every month. Those two things alone wreaked havoc on our monthly finances. We were scraping the bottom of the barrel every month and had absolutely nothing set aside for emergencies. Our parents bailed us out of “emergencies” many times, and while I’ll be forever thankful for their help, it was embarrassing as a grown adult to have to ask our parents for money.

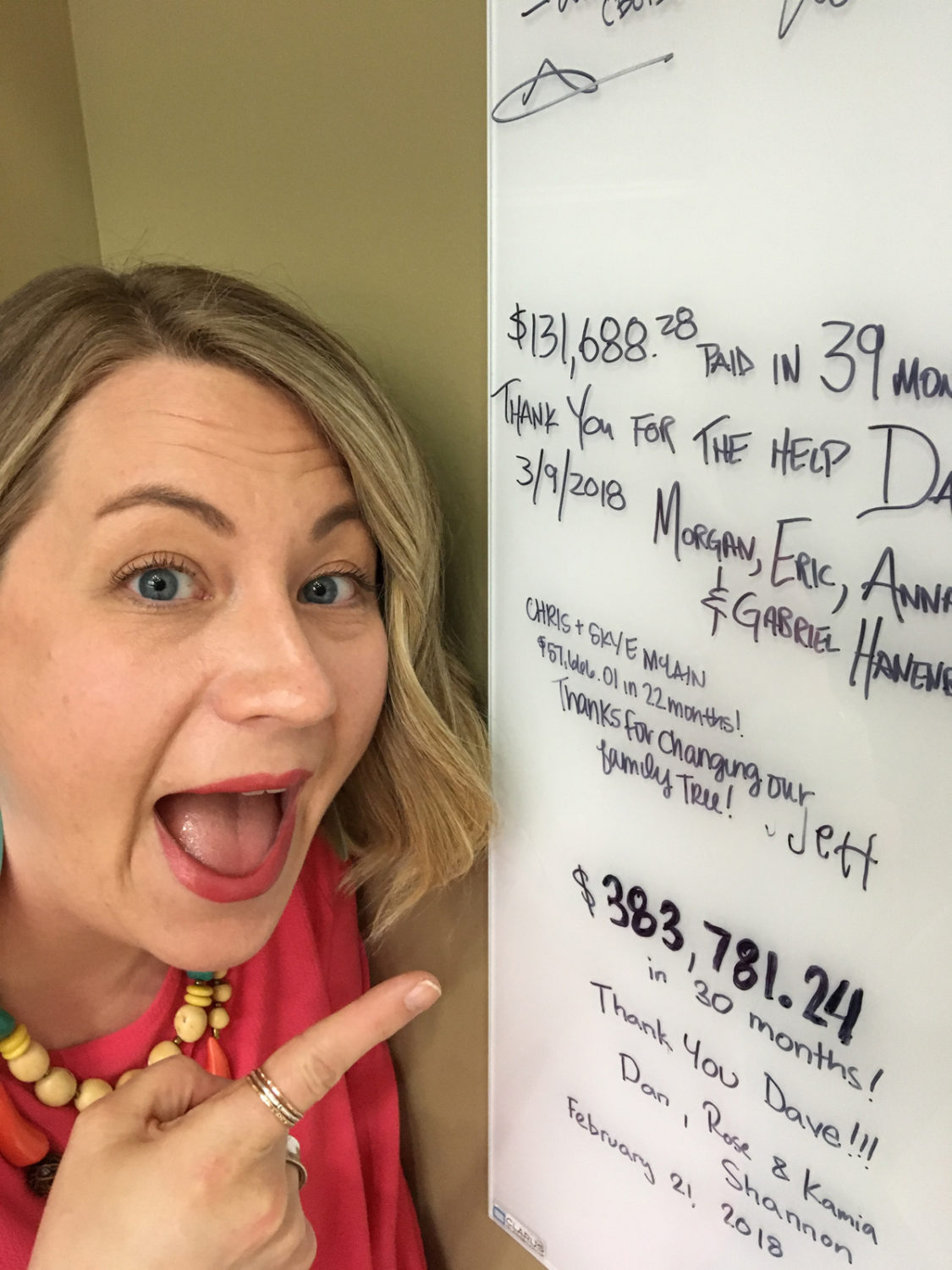

Fast forward three years and because we started working together on our finances, we were able to pay off over $57,000 in debt in 22 months, save up around $12,000 in an emergency fund (and still adding to it!), and plan for and save up for expenses. Here are some of the things we do now that we weren’t doing before that contributed to our success!

Monthly Budget Meeting

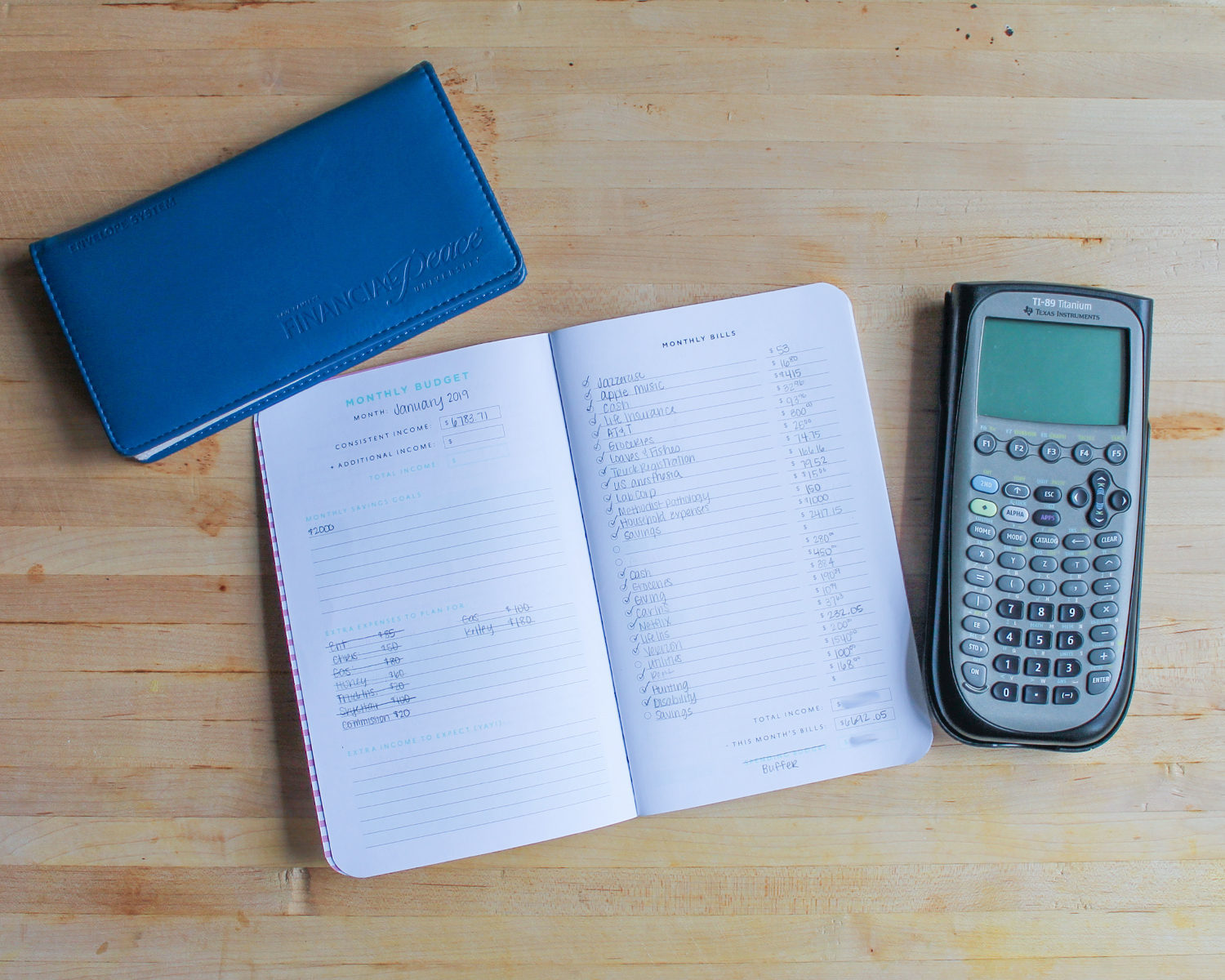

At the end of every month, after I prepare the budget, Chris and I have a budget meeting. When we first started out they were stressful and consisted of a lot of erasing and recalculating things until we got it to balance. At this point they take about 10 minutes and we look forward to them! But the key is that even though I do the prep work, we sit down together to make the decisions about what we are going to do every month with our money.

We also bring our social/work calendars to these meetings so we can make sure we haven’t missed anything we need to budget for, like dinner with some friends, some new clothes for Jett, or extra work money for Chris to travel with. We have found this social/work calendar option to be essential to our budget meeting because not only does it help keep the budget in check but it also helps with making sure we get everything on the calendar!

Financial Peace University

As a couple, we are currently leading our sixth small group through Financial Peace University. We generally have a group of other couples who are in the same stage of life as us (married a few years with young kids) and being an example to other couples has helped keep us accountable to this new lifestyle that we have. (It does still feel new sometimes lol!)

It has also helped to give us some perspective in parts of our budget that we have never had to deal with. We keep our budget so simple and we have cut out a lot of expenses that we don’t really need in order to save up money but not every other couple out there is like that. It has been interesting to see how other couples do it together!

It has also been super helpful and inspiring to us to see other couples win who have been in our group! We will get the occasional text or email saying something like “We paid off our credit card this week!” or “We paid cash for this car today!” or “We used cash all week and I’ll never go back to swiping a card again!” and I have to tell you – it is really awesome to know that we were there to help give them that foundation!

Talk About our Dreams

It was funny/amazing how our financial journey over the last three and a half years has changed our dreams. Things we never thought were possible are now on our horizon so talking about our dreams has turned into something fun, rather than a hopeless pipe dream!

Chris and I frequently (and by frequently I mean like, almost every single day) have some kind of conversation about our dreams and goals for the future. Things like paying cash for new-to-us vehicles, having a large down payment on a home, saving up for vacations, reaching certain retirement milestones, and increasing our monthly giving to our church are all regular topics of conversation in our home for a couple of reasons.

First off, keeping those dreams alive requires us constantly checking in with each other about them to make sure we still have the same ideas of what those dreams are. It can be easy to formulate all these ideas in your head about what you’d like to do with time and money, but if you aren’t talking with your spouse about them, they can begin to drive a wedge between you rather than bring you closer.

The second reason this is important to us is because we want to model this behavior for Jett, so that when he meets the person he wants to marry one day, money conversations will be part of that narrative. Chris and I spent the first 8 or so years never discussing money and we never made a single step of traction. If we can show Jett that it needs to be a part of your relationship from the get go, he and his future spouse will have much more success in their marriage and financially than if we don’t.

Ask for what you want

It is not only important to talk about those big dreams but you need to talk about those little things that you each want to do, separately and together, that will impact your finances. For my husband that usually has to do with hunting and for me it has to do with traveling and attending work functions like conferences and mastermind weekends. Before we had a grasp on our finances, we both always felt guilty “asking the other” for money. But now we come to the budget meetings deciding how we are going to plan our money, so there is no guilt or resentment about it anymore.

Offer forgiveness and let the past be in the past

Here is a big lesson we learned together – we are both human, we both made mistakes an will make mistakes in the future, and those mistakes could have a financial repercussion. When you start working together on your money, you will have to offer your spouse forgiveness for any financial indiscretions that they may have from the past as well as those that will likely come in the future. None of us are perfect, and it would do us all well to keep that in mind.

If you’ve never worked on your finances together, this new lifestyle will be a heavy enough burden to bear so don’t try and also bring along all your past luggage too. It will just weigh you down and cause resentment. Recognize the mistake, talk about the reason it happened, and then forgive, forgive, forgive.

For some it might not be that easy and if it isn’t find counseling. Reach out to your pastor or a marriage counselor. Some indiscretions are just a symptom of a marriage issue, not a financial issue, so be ready to recognize those too and find the proper help to get you back on track together.

Don’t hide purchases

It irritates me to NO END to see women say things like “I have to get all my packages off the porch before my husband gets home because he would kill me if he saw all of them!” or “My husband is going to see the credit card bill and be so mad!” (I’m not saying that men don’t have these same thoughts or behaviors but I just see it more from women than I do men because of the industry I work in).

One of the reasons it irritates me so is that I used to be that woman and I’m ashamed of it and angry at my past self for causing our finances the trouble I did. Since I work from home and do the brunt of the financial work, I’m generally the only person who sees our checking account and I’m home every day while packages are being delivered. It was easy for me to hide bags and boxes from Chris and just claim that we had “always had those pillows dear!”. My husband is not stupid – he knows we haven’t always had those pillows. #facepalm

Now that we agree on our budget and what we are going to spend our money on before the month begins, there is no need for me to hide anything from him. He knows what will be coming and going each month and so do I. It is the most freeing feeling on the planet; one that I want EVERYONE to be able to experience. So instead of buying stuff and trying to hide it, make a plan for it and agree together that it is necessary and going to happen.

I would love to hear what you guys do to work together with your money! If you have any tips or anecdotes to share leave a comment below!