Let’s just say that I’m glad February’s budget was easy, because this month threw us for a bit of a loop! Between catching the flu and needing to do a tiny bit of work on the car, I’m glad we do our budget with a pencil because it needed a lot of changes!

March Budget Update

Spring is definitely in the air, which means that I’m getting the itch to do lots of work to our house and yard to get it ready for summer! But of course, we have our budget to attend to, and this month’s was a serious doozy. I am glad to have this month behind us!

February Recap

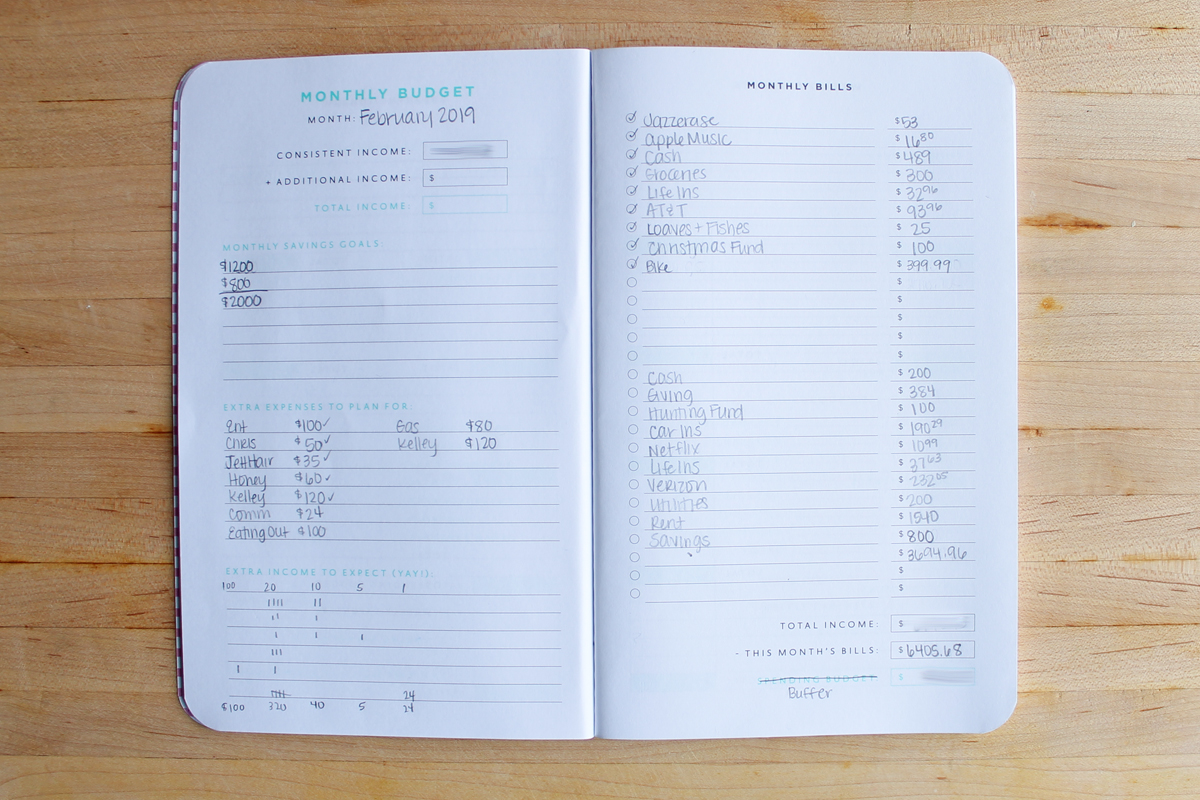

Before we go on with March’s budget, let’s do a quick recap of February. Here is what happened!

- February was honestly a pretty low-key month. We ended up putting $1600 into our emergency fund and I am very excited about that.

- We added an “Eating Out” line item to our budget, which is new for us! Between soccer games and lots of other things taking up our weekends, I wanted a break from cooking so planning ahead for that expense was like giving my future self a high five.

- The bike that we bought last month has already paid for itself in trips to and from my husband’s office to the main campus of the church. Now, he would like a cup holder to put on the handle bars. You give

a mouse a cookie… a husband an electric bike… - Everything else was pretty straight forward so we were able to pretty easily stick to our budget.

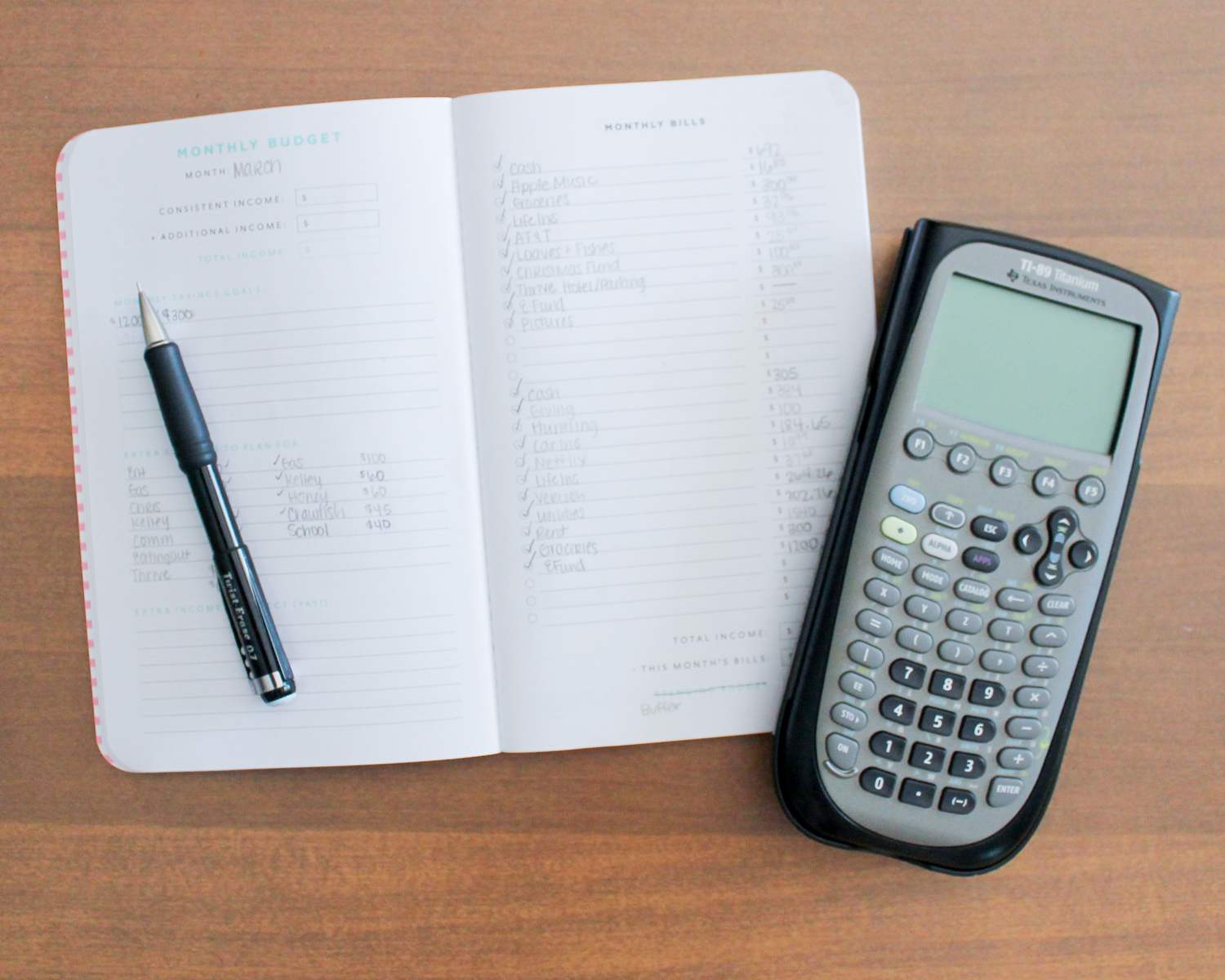

March Budget Plans & Goals

- Our budget this month had more expenses than normal because I had a conference to go to (Thrive!). My goal was to pay for it out of my business income, but lags in payment prevented that so we had to take it out of our personal budget (but I plan to reimburse ourselves as soon as I get some of my payments finalized!) So there was around $500 set aside for that.

- In addition to that, right before I left to go to Thrive, my son got the flu, so that came with a few expenses that we hadn’t planned for (who can plan to get the flu?) so we spent around $200 for doctor’s appointments and medicine for that.

- As of right now, at the end of March we will have right over $13,000 in our emergency fund! Our plan is to put another $1500 in there this month!

- And finally, halfway through February, I put my Jazzercise monthly membership on hold. I haven’t been going consistently for over a year, so it was time to just say goodbye to that (for now). So that $53/month is back into our budget.

Budget Meeting Agenda

Over the past couple of years, our budget meetings have gone from complicated meetings where I have to erase a bunch of stuff and recalculate everything in order to get our budget as tight as possible to now they take about five minutes and Chris just makes sure I didn’t forget anything!

This month was mostly talking about Thrive and planning for that big expense! I needed money for the hotel room, meals, and travel to and from the conference. That was the biggest discussion point of the meeting – everything else was status quo!

That is pretty much it!

For as crazy as this month has been, it is so nice to have a budget that sort of grounds us. When you have a plan for your money, all those crazy things life throws at you are just life problems, not life problems AND money problems! So knowing how insane it felt vs. seeing how it actually played out on paper is interesting!

If you’ve never done a budget before read this post before you get started! If you’ve never had a budget meeting, check out this post to help you plan for it. Let me know how your budgets are going in the comments!