Guess who’s back…. back again? Back with another budget update for you! I have really enjoyed sharing these with you guys because it provides another layer of accountability for us to stick to our budget! Here is April’s budget update!

April Budget Update

Well we have two months of school left, so it is time to start thinking about how we are spending the summer and that is reflected a bit in our April budget! But before we go on with that, let’s recap March real quick.

March Recap

Before we go on with April’s budget, let’s do a quick recap of March. Here is what happened!

- Woof – March took a hit. We had grand plans of saving a chunk of money but having Thrive and a sick kiddo and spring break kind of put a dent in those plans.

- It is clear to me that I did not plan well enough for Spring Break this year, so next year that will definitely change. I’m planning on setting aside more money for eating out that week, some daytime activities, like Pump it Up or Urban Air, and perhaps plan a day trip or something for us to get out of the house for a day!

- We did go over our goal of $13K in the emergency fund and ended the month with $13,304! It is the most we have ever had in there so *pats self on the back* GO US!

April Budget Plans & Goals

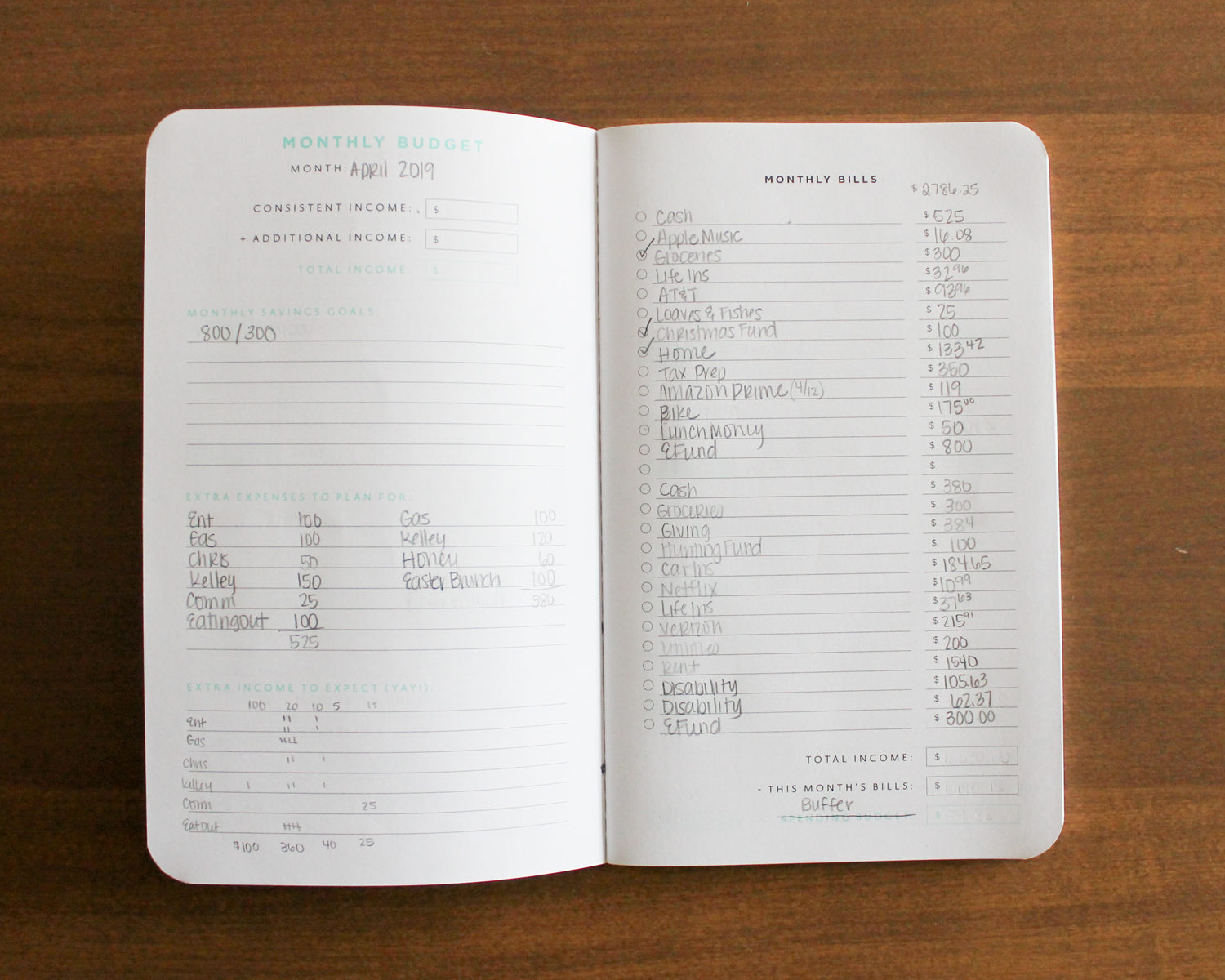

- Oh April. I had really high hopes for you to be a light budgeting month but unfortunately, that is not the case! Between paying for our Amazon Prime membership, paying for our accountant to do our taxes for us, and Chris agreeing to get me a bike for my birthday, it quickly filled up nearly every line on the budget. Yeesh.

- However, we are still pushing forward and plan to put at least $1000 in our emergency fund which is progress for sure! It still amazes me that we can pay all of our bill, plus pay for lots of fun stuff, and still have money for the emergency fund. Benefits of being debt free and making a plan for your money each month!!

- I would really like to have a garage sale this month – and our neighborhood is having one on April 27 – so I think we will do that in order to make a little extra cash to purchase a canopy gazebo for our back yard for this summer! I will be sure to report back on that in May!

Budget Meeting Agenda

Over the past couple of years, our budget meetings have gone from complicated meetings where I have to erase a bunch of stuff and recalculate everything in order to get our budget as tight as possible to now they take about five minutes and Chris just makes sure I didn’t forget anything!

This month was mostly talking about what kind of improvements we wanted to make to our yard in April and May (hence the canopy gazebo line item above), how we were going to pay for those, and what was most important first. We would also like to have a small fenced off portion for the dogs, but there will be more on that later!

That is pretty much it!

As crazy as this sounds, I love budgeting so much. It gives me so much peace about our money and control over where things are going that I look forward to it every month!

If you’ve never done a budget before read this post before you get started! If you’ve never had a budget meeting, check out this post to help you plan for it. Let me know how your budgets are going in the comments!