Here is our budget update for April and May!

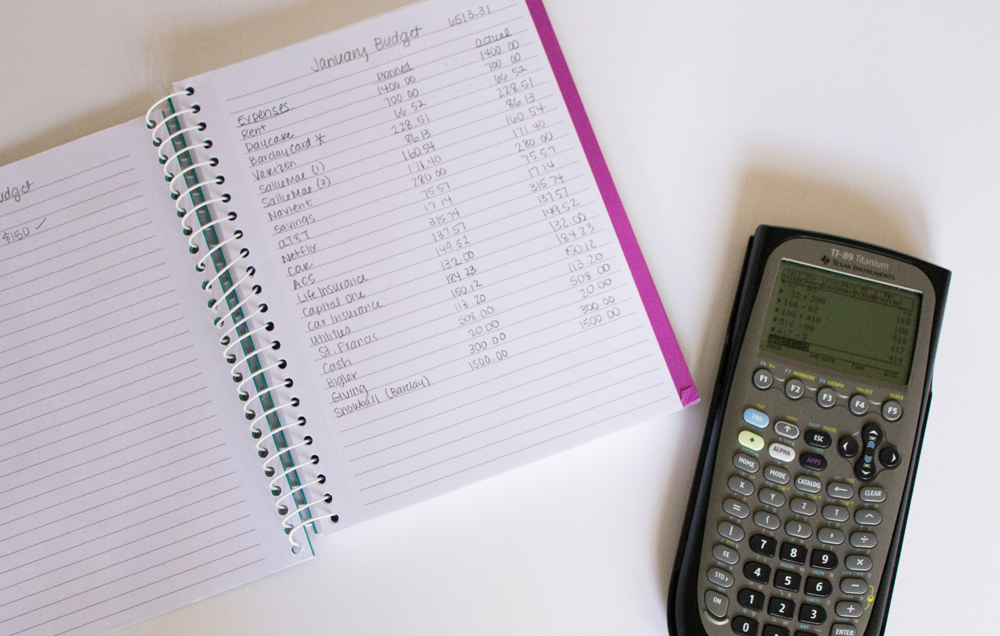

Here is a reminder of what we are working with:

OUR DEBTS

- Best Buy Credit Card: $441.23

- Student Loan #1: $859.03

- Spark Business Card: $1,409.59

- Barclay Credit Card: $2,377.31

- Student Loan #2: $2,939.64

- Student Loan #3: $4,464.77

- Student Loan #4: $4501.44

- Capital One Credit Card: $4,911.49

- Student Loan #5: $5,427.62

- Student Loan #6: $9,772.15

- Car Loan: $6,800

Total: $43,912.99

WHERE ARE WE NOW?

Best Buy Credit Card: $441.23Student Loan #1: $859.03Spark Business Card: $1,409.59Barclay Credit Card: $2,377.31Student Loan #2: $2,939.64- Student Loan #3: $4,464.77

- Student Loan #4: $4501.44

- Capital One Credit Card: $4,911.49

- Student Loan #5: $5,427.62

- Student Loan #6: $9,772.15

As of today, our total pay-off amount is $6,891.75 in four months. Yippee!! We still have a long way to go, but we are definitely making some scorched earth progress so I am super proud of us! It just proves to me, over and over, that making sacrifices now is really going to pay off for us in the long run!!

WHAT HAPPENED IN MARCH

In March, we really concentrated on sticking to our cash budget envelope system. I think that was the main key to our success last month! We had a couple of different budget meetings to keep our cash on track but we stuck to it and had a little over $2,000 left to make our debt snowball payment!

In case you’re wondering about the cash system, this is how and why it works. We plan a budget for specific items each month that we can easily over spend on and use cash for them instead. When we run out of cash for that item that month, we don’t spend anything else in that category. The reason it works, for me anyways, is that in the past every time I would use the debit card, I was terrified I was going to make our account go into the red and another payment going through was going to bounce. That is a terrifying feeling. But now, I can by groceries or gas knowing without a doubt that the purchase is not going to mess up our budget. Spending with cash is SO FREEING for me. I use our simple cash envelope system from Dave Ramsey’s website to store and carry it all with me and it makes it super simple. Now that we have gotten in to the routine, I don’t even have to keep up with

We were hoping to have our cash payout from our Whole Life policies BUT it takes a little longer than we estimated to secure a term life insurance policy! I had to pee in a cup FOUR TIMES but in the end it will be worth it for the wait! That $5,300 cash value is going to make a huge dent in our debt total.

BEHAVIOR UPDATE

Now that we are well out of Financial Peace University, it has been a lot harder to stick to the plan since we haven’t had a group of people to be accountable to. We have had to be more adult-y adults and stick to things on our own and it has helped to have that nice foundation of “we are in this together and we are sacrificing together” in our marriage from FPU to lean on.

We have also discovered that it is really a lot of time and energy to remain focused on this big goal and that we have had to let go of several other things in our lives that we didn’t realize were holding us back. We own a graphic t-shirt business (Your Texas is Showing) that we have just basically stopped promoting and working on in order to put our full focus on to this.

So, my question for you this month is, what is really holding you back? Why are you letting it? And what can you do to really begin to put your goals in a priority position and really achieve whatever it is you’re working towards? Let’s do it!

Are you wanting to turn your finances around? All it takes is one decision to start doing things differently! Take my free five day challenge to jump start your financial makeover!

Are you stuck in a rut with your finances? Do you constantly feel overwhelmed by money problems? Do you feel like you can never get a handle on your money? Let me encourage you to take my five day challenge to jump-start your financial goals! You’ll learn:

1. How to really feel your money

2. How a cash flow plan can set you free

3. How to set long term and short term goals

Plus learn how to evaluate your income and make it work harder & smarter for you!