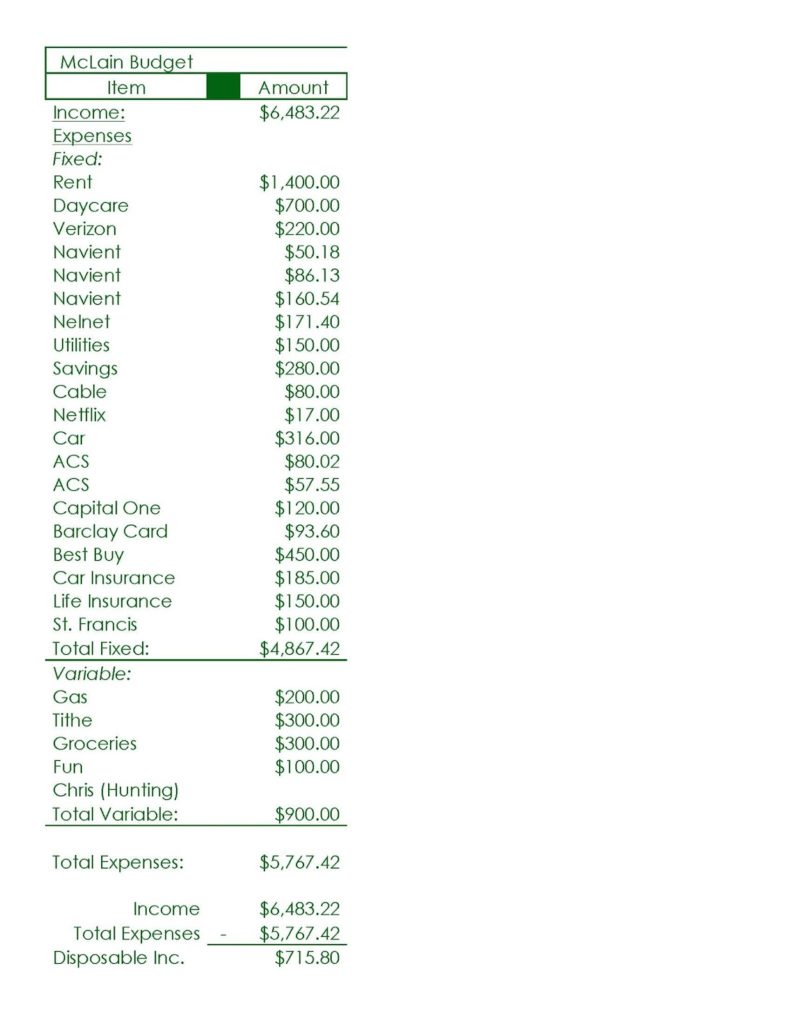

Time to get really awkward up in this space. Why is money and how much people make such a taboo subject? It is just money, and as Dave says, we are just given this money by God to steward until it is time to give it back to him, so why be secretive about how much he trusts us with? So here is a look at our real, live, actual budget.

I’ve done this once before, a long long time ago, when we first learned about Dave Ramsey and tried to start this then. You can see that post here.

A few notes:

• This is our budget breakdown as of December 1, so at the time this is publishing it will have already changed, given that we have already paid off two of our debts. #spoileralert – blog post about that coming soon! ha!

• We have pared down our expenses as much as possible to up our “disposable income” every month, which is what goes toward our debt snowball. We still pay for “cable” which is really our internet service because I work from home so that is a business expense. Our cell phones are also a business expense since we both use them for work, so we are able to use that monthly bill as a tax write-off at the end of the year, which is why it is so expensive.

• The St. Francis bill is Jett’s hospital bill, and it is officially paid off as of January! There is a balance of $113 left on it that I’ll be paying off next month. I did not count that as a loan in our debt snowball because the balance was so low, manageable, and because it was not getting charged any interest.

• All of our variable expenses come out in cash at the beginning of the month and go in our Financial Peace envelope system. This was a game changer for us – the first go at this we tried to just use our debit cards and stay under budget but that was nearly impossible for us. No, in fact it was impossible. It was just too easy to justify a purchase over budget when I used a debit card. When we started this again in December, and I bought gas for the first time with cash, it was absolutely freeing. Knowing I hadn’t touched the money in our checking account was literally a weight lifted off my chest. I was officially hooked to the cash system.

• As a “modified” part of the Dave Ramsey method, we have a $280 payment transferred out each month in to a credit union account we have labeled as our emergency fund. This is residual from our truck being paid off shortly before we started and we just decided to keep that line item in our budget and start building our emergency fund while we were working the snowball, as well as continue adding to it monthly even after it is established. We are thinking of it as a slush fund of sorts as well for giving and traveling once we get our debt paid off.

So there is an overall look at our budget for the next couple of years! It is freeing to know that for the first time in several years we actually have a real shot at getting out from underneath all of our debt so we can focus on our futures instead of surviving the here and now. I’ll be posting an updated version of it each month as we go as well as a report of what we paid towards our debt. Keep an eye out in the next few days for a snapshot of the loans we have rolled in to our snowball and our estimate goal for paying them off too!

Are you stuck in a rut with your finances? Do you constantly feel overwhelmed by money problems? Do you feel like you can never get a handle on your money? Let me encourage you to take my five day challenge to jump-start your financial goals! You’ll learn:

1. How to really feel your money

2. How a cash flow plan can set you free

3. How to set long term and short term goals

Plus learn how to evaluate your income and make it work harder & smarter for you!